Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

December 2005

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities, Books and Gatherings

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

Lies, lies and more lies - we're just so good at it! (See Holonics for more of the science.)

A World Economic Forum/Globescan survey indicates that trust is declining globally, despite immense wealth and a reasonably fruitful year in most economies. Trust in Governments, Corporations and Global Institutions Continues to Decline. Of all the institutions examined, national governments have lost the most ground over the past two years. In twelve of the sixteen countries for which tracking data is available, public trust in the national government has declined by statistically significant margins, leaving only six of the tracking countries today with more citizens trusting their national government than distrusting them. Trust in government has fallen the most in Brazil, South Korea, Mexico, Canada and Spain, followed closely by Argentina and the United States. The case of Nigeria is also noteworthy, where trust in the national government fell by thirteen points while trust in all other institutions rose. Even in countries such as Great Britain and India, where trust remains positive, it has suffered its biggest fall since tracking began in 2001.

The institutional dishonesty that we are oblivious to was thrown in our faces in December by our global superpower on several fronts. We learned that US security institutions export prisoners to foreign locations where many believe torturing to have taken place, and we learned that probably illegal and certainly immoral surveillance is being ordered on US citizens by the President. But the most shocking fact was the admission by President Bush that he lied, in particular about weapons of mass destruction, Al Quaeda and Iraq. It seems that everyone thinks its OK for the President to lie, because if his name was Richard Nixon he wouldn't be in office today. It is unlikely that we will see a confession from Bush like that of eight-term Republican congressman Randy Cunningham charged with accepting $ 2.4 million in bribes and evading over $ 1 million in taxes: " I broke the law, concealed my conduct and disgraced my high office". Instead we heard W tell us all that he lied, but its OK because he's in charge. He again used the excuse that he would do what he thinks necessary irrespective of the law or ethics. The founding fathers must be turning in their graves.

For me however, it is not OK just to do the right thing, it must be done in the right way. ( I have been at the sharp end of bullying, as both child and adult, too often to think otherwise.) Too often privilege has been used to execute decisions, good and bad, but that is not equity or justice. The US appeared to be a strong meritocracy "anyone can make it" - and that has been attractive. But that has been lost in recent years at the highest political office. When the President stands up and says "I lied and cheated, but I did the right thing so its OK" as he did in mid-December, democracy is not in effect at all. Neither institutions, media nor people have challenged teh US's evangelical leader about this failure of ethics. I believe that responsibility is the price of power - and if ethics are absent the power is ill-deserved. (A company, like Enron, can not say we lied and cheated but we enriched our shareholders so its OK.) The US behaves as a monarchy or dictatorship, even if benevolent. One estimate is that over 25,000 civilians have been killed in Iraq in the last couple of years - even by world trade centre standards that is huge. It is be difficult for us all to balance the tension of being a loving and caring person and also loyal, yet circulating in a world where peers and friends make daily decisions that are inequitable and polluting the planet.

The New York Times reported on their survey conducted with TIAA-CREF and Harris Interactive entitled Mutual Funds Investors Rate Public Figures. The numbers are worrying - perception is often a reflection of reality and people are obviously aware of dishonesty in the corridors of power but are also seemingly unable to do much about it. You can read more analysis by Claudia Deutsch in The New York Times: "New Surveys Show That Big Business Has a P.R. Problem,"

"Who Do You Think Is Very Trustworthy?"

| President Bush |

27% |

| Supreme Court |

25% |

| Congress |

4% |

| The News Media |

4% |

| Fortune 500 CEOs |

2% |

"Who Do You Think Has Too Much Power in Washington?"

| Big Companies |

90% |

| PACs |

85% |

| Political Lobbyists |

74% |

| The News Media |

68% |

| Labor Unions |

43% |

Coincidentally newly minted Nobel Laureate Harold Pinter's Nobel Lecture delivered in early December reflects on the same subject: Art, Truth & Politics. You can read the speech here, though its title reveals the gist: most communication, including art, is not true - it is instead a reflection of reality. And the important difference is whether or not it is honest. (We have all been in professional situations where we have told the truth but created an illusion to entice others into action, usually to buy something.)

In

recognising the most significant events of 2005 people highlighted disaster

and war, rather than positive change like poverty alleviation.

The results of the worldwide BBC poll are summarised in this chart.

You can read the article

here or the poll

results here.

In

recognising the most significant events of 2005 people highlighted disaster

and war, rather than positive change like poverty alleviation.

The results of the worldwide BBC poll are summarised in this chart.

You can read the article

here or the poll

results here.

From the other side of the world, China News Weekly shared a wish list for 2006. The article in English is here. For those of us who feel fear or that they are not getting their fair share in life, it makes interesting reading. This is how it begins:

-

Facing 2006, we hope that China's reform will make critical progress in challenging areas, the country will be prosperous and people at peace; and society will be harmonious;

-

We hope that there will no longer be so many miners who die in the dark underground, and that their families will no longer be so worried when they go to work;

-

We hope that every death penalty case will be under the strictest scrutiny by the most experienced judges, excluding all doubts, and every single death penalty case will be proven over time, even if this means high operating costs for the judicial system;

-

...

Our wish is that we all have the strength to do the right thing, the right way.

Investment, Finance & V. C.

Figures released by the Department of Commerce show that the US

economy grew at an annualised rate of 4.3% in the third quarter,

revised upward from a preliminary estimate of 3.8% issued in November.

The Department of Labour reported that over the same period, productivity

had grown by 4.7%. And jobs are being created as quickly as interest

rates rise. It is a conundrum that fundamentals are shaky but performance

is good. In another part of the world we would assume numbers had

been fudged. But the reality is that size, complexity and integration

of social and economic dynamics globally is changing the rules and more

chaordic analysis is needed.The most positive ingredient in America's

performance is its culture of change and adaptability. If intellectual

stagnation does not take hold, innovation could provide the energy for

continued wealth creation and its more equitable distribution. Nevertheless,

we do not expect strong performance in 2006, though sharp downturns are

unlikely too.

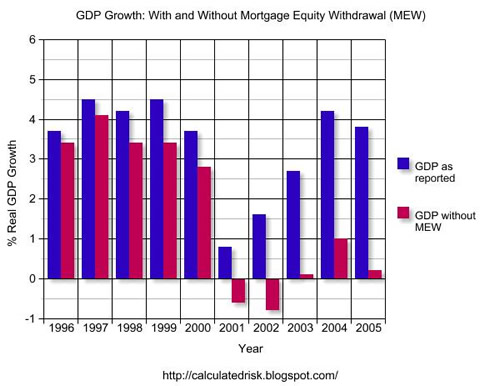

US consumer spending has been higher than expected for some years now, but there are signs that the inevitable swing may occur in 2006. It will change when there is a change in consumer sentiment - when people start to feel that they have enough stuff. But it will also be catalysed by economic balances. At the moment spending has been fuelled in particular by monetising home values. These charts shared by Paul McCulley, Managing Director of PIMCO and John Mauldin, the increasingly famous macroeconomist and hedge fund consultant, show how extended the pendulum is.

To reiterate the quote above in Risk and Terror by Paul Volker speaking of financial markets: "I don't know whether change will come with a bang or a whimper, whether sooner or later. But as things stand now, it is more likely than not that it will be a financial crisis rather than a policy foresight that will force change."

While markets appear exuberant it is prudent to have a strategy planned

should a slowdown occur in 2006. Holiday season sales were below

expectations and may be an early harbinger of 2006 performance.

According to the Ifo research institute, Germany's GDP is estimated to have improved in 2005 hitting a higher-than-expected 0.9% will expand by 1.7% next year, compared with an earlier forecast of 1.2%. Growth in the German economy, Europe's largest, is expected to be lifted by exports and stronger investment. The report is another suggesting the recovery is becoming more sustainable. Concerns still exist, however, and producer prices surged to a 23-year high in November - driven by oil prices and energy costs - climbing in November from the same month a year earlier. The monthly rate was less worrying, declining by 0.1% in November from October.

Inflation remains a worry in major economies: in the US it is inflation that may push the Federal Reserve to raise rates beyond 4.5%, in Europe the European Central Bank is expected to raise interest rates unless inflationary pressures diminish in coming months, and in Japan inflation has been seen for the first time in a decade as that economy's restructuring begins to take hold and rejuvenation accelerates.

The Japanese market was up over 35% in 2005. While we are still positive about the fundamental changes occurring in Japan, including cultural, social and political, the risk/return profile is now more balanced and selection more important.

Continuing modernisations promoted by Japanese Prime Minister Junichuro Koizumi are liberating more of Japan's potential. The cabinet has approved a gender equality plan that aims to put more women in leadership positions. It gave the green light to a series of measures to improve employment conditions for women and encourage their return to work after maternity. The changes, known as the female re-challenge plan, are in response to Japan's plunging birth rate. Japan's population contracted in 2005 for the first time since records began more than a century ago, and politicians are alarmed by the absence of women from the shrinking workforce. Over two-thirds of Japanese women do not return to work after childbirth. Only 11% of management positions nationwide were held by women as of 2004 - but that is up from 8.3% in 2001. The plan aims to redress the perceived failures of an equal opportunities law enacted 20 years ago. New measures include granting flexible hours and training programmes to women who return to work after maternity, using vacant retail space for childcare centres and providing financial support for women entrepreneurs. The plan aims to push girls towards science and technology studies from an earlier stage, and the cabinet has set itself the target of filling a third of all leadership positions with female managers by the year 2020.

Goldman Sachs followed in the footsteps of global financial institutions Citigroup, Bank of America, and JP Morgan Chase in adopting a comprehensive environmental policy. The policy combines important philosophical statements, for example acknowledging the reality of human-induced climate change, with practical commitments, such as the goal of reducing indirect greenhouse gas (GHG) emissions from leased and owned offices by seven percent by 2012. Setting the GS policy apart from other banks' policies is its commitment to the United Nations Millennium Ecosystem Assessment (MA), as well as its $5 million donation to establish the Center for Environmental Markets to study how the free-market system can solve environmental problems. What mostly sets the GS policy apart, though, is the type of bank it is - an investment bank. "This policy does not break new ground when it comes to substantive environmental issues," said Michelle Chan-Fishel, head of the green investments program for Friends of the Earth (FoE), which has engaged with GS for a number of years on environmental issues. "However, it's significant because Goldman Sachs is the first 'pure' investment bank to develop such a detailed environmental policy." As reported last month, the United Nations Environment Programme Financial Initiative (UNEP FI) commissioned GS to conduct research on the materiality of environmental, social, and governance (ESG) issues in the oil and gas sector that resulted in a well-regarded report that served as an impetus for creating the policy. "The report found that indeed 'environmental and social issues count,'" Ms. Chan-Fishel points out. "After producing that report, a light bulb went off at Goldman Sachs, and it realized that ESG issues could be material for other sectors as well."

A consortium led by Citigroup has made a successful bid of 24.1 billion yuan ($ 3 billion) for a controlling stake in Guangdong Development Bank. The deal is for 85% of the state-owned bank, with Citibank keeping a 50% stake and the remaining shares split among several Chinese partners. It will make Citigroup the first overseas company to buy a controlling stake in a state-run Chinese bank. However, such a deal would need to be approved by the government, which has set a 20% limit on foreign investment in Chinese banks.

Australia & New Zealand Banking Group Ltd. agreed to buy a 19.9% stake in China’s Tianjin City Commercial Bank for about US$120 million. The deal is ANZ’s first direct investment in a Chinese lender and continues a push by Australian banks to secure a foothold in the world’s fastest-growing major economy. Tianjin is China’s third-largest city and part of the Bohai Bay development region that includes nearby Beijing.

New research by McKinsey indicates that Chinese consumers lack confidence in their financial future and are saving a quarter of their income to cover health care and retirement. This is as much traditional Chinese culture as prudent wealth creation (and a trend that the US and Europe would like). Nonetheless, shopping lists for the next 12 months include big-ticket items such as flat-screen TVs, automobiles, and new homes. Consumers in towns and smaller cities - now a key battlefield for multinationals and domestic companies alike - are intensely interested in big-ticket consumer goods. While branded fast moving consumer goods are a sign of wealth and a contributor to obesity among molly-coddled children, conspicuous over-consumption is not widespread as it is in the US and Europe.

For its 10th-anniversary issue, Strategy & Business magazine asked itself: Of all the Big Ideas we have covered over the past decade, which are most likely to endure for (at least) another 10 years? Here's their answer:

1. Execution

2. The Learning Organization

3. Corporate Values

Its is encouraging to see ethics and education in the top three. (See the rest of the list, as well as great references for each Big Idea here.)

Responsible Investing

GE has proclaimed its "greenness" and will start measuring performance by a set of non-financial parameters, including CO2 production. That will be a difficult change of culture. But one which will keep the high calibre people at GE interested. And, being led from the top by Jeff Immelt, has some chance of success. It remains to be seen how much is greenwash. A strong indicator of culture change will be liquidations of irresponsible assets in 2006. And Immelt will find quickly that critical thinking is required to change in tune with the emerging enlightenment of the marketplace.

Unilever which has pioneered change from within for over half a decade shows how challenging it can be to reengineer culture. Unilever has completed a groundbreaking project with Oxfam that sets out to explore the fraught question: does international business investment help or hinder the fight against poverty? Opening its internal documents to scrutiny by campaigners for fairer globalisation is a truly bold move for a multinational company operating in impoverished parts of the world. For nearly two years, the consumer goods company has allowed Oxfam to probe and analyse its socio- economic impact in one very large country, Indonesia, where it sells soap, soy sauce, ice cream and mosquito coils to consumers, more than half of whom live on less than $2 a day. Oxfam says the research, which concentrated on Unilever’s operations in 2003/4, challenged its view that expansion by a multinational squeezed domestic companies. Although the findings were not conclusive, “it appears that during the period under review, competing domestic industries had expanded rather than contracted”. The charity is open about the risk that its collaboration with Unilever will attract criticism from partner organisations and colleagues skeptical about the potential of multinationals to benefit poor people. But it says there are lessons for other NGOs in what it discovered about Unilever. A surprising finding is that more people are employed, and more value is generated, in the distribution and sale of goods than in the supply chain. Unilever, which has been active in Indonesia since 1933, calculates that 90 per cent of poor consumers buy its products in the course of a year.The jointly funded report, which is available on the Oxfam UK and Unilever websites, estimates that the company indirectly provides the equivalent of 300,000 full-time jobs, in addition to its 5,000 direct employees. More than half of this indirect employment is in distribution and retail, including up to 1.8m small shops, street hawkers, kiosks and warung, outlets that operate from family homes.

The Operating and Financial Review (OFR), the UK Department of Trade & Industry (DTI) regulation that came into force in March 2005 mandating annual corporate disclosure of non-financial environmental, social, and governance (ESG) information, was shot dead last week. In a speech before the Confederation of British Industry (CBI--the voice of business interests in the UK), Chancellor of the Exchequer Gordon Brown killed the initiative, citing concern over "goldplating"- or blind adoption of European Union regulations. The move came as a surprise as the creation of the OFR, which dates back before 2002, resulted from a comprehensive consultation process coordinated by a working group assembled by DTI representing a broad spectrum of affected parties, including SRI practitioners. Indeed, while considerable consultation went into the creation of the OFR, it seems precious little went into its scuttling. We have to agree with environmentalist organization Friends of the Earth (FoE) in the UK which sent a letter to Mr. Brown claiming his decision was "procedurally unfair, irrational, perverse, a breach of legitimate expectation, and based upon material errors of fact." FoE's letter claims that the Chancellor's failure to consult before making the decision was in breach of the UK government's Code of Practice on Consultation. "We have written to Mr. Brown today to warn him that unless he can satisfy us that his decision was lawfully made we intend to seek a judicial review," said FoE legal advisor Phil Michaels. "The decision was a breach of fundamental public law principles of fairness and due process." More than that it is likely to be to the detriment of UK competitiveness because it has been proven that a triple bottom line business culture creates more value.

‘Rewarding Virtue – effective board action on corporate responsibility’ by Insight Investments here and executive summary here.

The Co-operative Bank, which has just carried out a survey into ethical consumerism, found that the value of ethical consumption increased by 15% in 2004 to a staggering £ 25.8 billion. The reason for this huge figure is that it includes categories such as ethically invested funds (valued at over £10 billion) and products and services bought because they offset climate change (£3.4 billion). Spending ethically on food — including organic food and free-range eggs — surpassed £4 billion for the first time, whilst spending on ethical fashion reached £680 million. These markets are reaching critical mass and have strong growth potential too, unlike other sectors.

The newest in the Megatrends series advances a framework for conscious capitalism that highlights socially responsible investing. The chapter on socially responsible investing in Megatrends 2010 (Hampton Roads), which seeks to harness the popularity of best-sellers Megatrends (Warner BooksMegatrends 2000 (William Morrow 1990), will likely drive greater interest in SRI. The Megatrends books have become a kind of self-fulfilling prophecy: they not only identify significant trends, but also spur them. Author Patricia Aburdene frames SRI as one of seven "megatrends" ushering in "conscious capitalism," which fuses free market economics with social responsibility and spiritualism. (See book review here.) "SRI is becoming a megatrend for two reasons, one 'top-down,' the other 'bottom-up," writes Ms. Aburdene. "At the grass roots level, people insist on 'investing with their values,' as [GreenMoney Journal founder] Cliff Feigenbaum and the Brills [Investing with Your Values (Bloomberg Press 1999) authors Hal and Jack] would put it." "At the macro level, after Enron et al., even Wall Street's institutional investors got the message: Corporate ethics--or, rather, their lack--can nuke your portfolio".

A current summary of SRI and why it is growing came from finance-magazine.com: Socially responsible investment – the future of investment? Editor Ellen Bailey is senior investment consultant with Mercer Investment Consulting and notes that education remains a key issue for the SRI industry. "For many, socially responsible investment still conjures up visions of negatively screened funds with a particular ‘agenda’ to pursue. In fact, this approach is only adopted by a comparatively small amount of assets under management in SRI funds. The combination of increasing interest in SRI, coupled with new, more acceptable mainstream approaches for its implementation, appears likely to result in the rapid growth of SRI assets under management over the coming years. Increasing awareness of the impact of ESG issues on company performance is also likely to encourage the further integration of SRI teams and their mainstream investment colleagues and confirm SRI’s place in the wider investment process."

The Financial Times has created a global awards programme recognising banks that have actively integrated social and environmental objectives into their operations. Banks from both developed and emerging markets will be invited to enter for awards in five different categories. The deadline for initial entries is 1 March 2006.For further information, please write to: sustainablebanking@ft.com

And to round out this section on Responsible Investing lets have some food for thought from Adam Smith:

Every individual necessarily labours to render the annual revenue of the society as great as he can. He generally neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of his intention. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.

Venture Capital

Indian VC seems to be growing significantly with reports of large funds being launched: ICICI Ventures, the Hyderabad, India-based venture capital arm of India’s second largest Bank, ICICI Bank, is nearing a close on its $750 million India Advantage Fund III. It is considered the largest single VC fund in India’s history and is almost triple the size of the group’s previous VC fund, which was $250 million. The group held a first close of $250 million in November and hopes for a final close in January. LPs in the first closing are primarily Indian institutional investors with the exception of Swiss Re, the multi-billion Swiss re-insurance firm. Sudhir N. Nariyar, the director of investments at ICICI Ventures, says that the firm is already looking at investments for the fund. The San Francisco Employees’ Retirement System, which manages more than $12 billion of assets, plans to invest in India. The pension fund’s entry follows that of the California Public Employees’ Retirement System, which went into India in January 2005. E David Ellington, a trustee of the San Francisco retirement board, says that the fund is evaluating investments in infrastructure and real estate. Mumbai India-based Housing Development and Finance Corp. HDFC announced that it would launch a new global realty fund in the first quarter of 2007. The fund will enable non-resident Indians and foreign institutional investors to invest in real estate projects in India. The fund is being launched in association with State Bank of India. The fund will be managed by HDFC Venture Capital Ltd. HDFC hopes to raise about $400 million from the foreign market and a spokesperson from HDFC says that the company will seek significant institutional funding from its offices across the middle east.

A useful introduction to family business dynamics by Joachim Schwass of IMD is here.

Interest Rates and Currencies

China has approved 13 domestic and foreign banks to act as market-makers for yuan trading, in another move towards a more flexible currency. China plans to bring in a market-making trading system for the yuan early in 2006, letting it float more freely against foreign currencies. According to reports, the 13 banks include foreign lenders Citigroup, HSBC, ABN Amro and Standard Chartered. As China's currency becomes more freely traded it will play a bigger part in global financial flows and remove some incentive to hold US$ as a single reserve currency.

US rates rose to 4.25% and are expected to rise again in January - Greenspan's last - to 4.5%. While this had been the expected point of flattening, it is now more likely that rates will rise another 0.5% in the first six months of 2006. US rates are under scrutiny because there is an inversion in the yield curve (scroll down linked page) which may become more accentuated when short term rates rise again, if long term rates do not follow. The inversion of the yield curve (short term rates are higher than long term rates) especially between the 3 month and 10 year tenors, have historically been very reliable indicators of an impending recession in 6 to 18 months. While nothing can be predicted with certainty, the inverting yield curve is a red flag and its impact should be considered in portfolio and strategic planning.

US consumer prices fell 0.6% in November, marking the sharpest slide in 56 years. The fall was driven by a record 8% drop in energy costs in the month, following a previous surge in oil prices in the wake of Hurricane Katrina. Analysts had been expecting a 0.4% fall in US consumer prices. The larger decline will come as some relief to the US Federal Reserve, which has been raising interest rates in a bid to dampen inflationary pressures. Excluding food and energy costs, the so-called 'core' measure of US inflation rose in-line with forecasts by 0.2% in November. Over the past year, US consumer prices have climbed by 3.5%.

The appetite of UK consumers for new debt has fallen to its lowest level for 11 years. Bank of England figures show that in November, the growth rate of consumer credit - such as credit cards and bank loans - fell to just 9.8% a year. That was the slowest growth recorded since September 1994 and a fall from the recent peak of 16.1% in 2002. Unsecured borrowing rose in November by its smallest amount for nearly five years, at just £900 million. The Bank of England said this was mainly due to a drop in credit card spending, which it said was £0.3 billion lower in November than in October - people are tending to use debit cards instead, which is a much more prudent tool for managing current consumption.

Trade and FDI

The WTO ministerial meeting in Hong Kong was not as disastrous as expected, but was still embarrassingly pathetic. A limited trade deal has been reached in Hong Kong after developing countries approved a European Union offer to end farm export subsidies by 2013. It is hoped that it will pave the way for a global free trade treaty in 2006. Yet only modest progress was made in other key areas, and officials admitted much more work needed to be done. "This is a profoundly disappointing text and a betrayal of development promises by rich countries whose interests have prevailed yet again," said Oxfam's Phil Bloomer.

The main points are:

-

Agricultural subsidies: Farm export subsidies will progressively be phased out by 2013. However, there has been no agreement on import tariffs.

-

Cotton: Rich countries will phase out export subsidies for cotton, but there is no agreement on a date for reducing domestic subsidies for US farmers. (The US is resisting pressure to rapidly reduce the subsidies it gives to domestic cotton farmers, a source of great concern for African countries.)

-

Development Aid: The poorest countries will get quota-free and duty-free access to global markets for 97% of their goods.

For further detail see a Q&A on the Trade deal here. And in pictures: WTO protests.

The tragedy of GM contamination of nature continues to strangle earth's potential. To force genetically modified products into global markets, the US has filed a legal dispute at the WTO, accusing the European Union of blocking trade by restricting GMOs. The US argues that Europe's position on GMOs violates WTO rules and is a barrier to trade. In particular, it claims that US farmers have lost exports because they grow GM crops not approved in Europe, which is presumably their choice to do so. President Bush later added that the EU's moratorium was impeding efforts to feed the world, which is another myth since in fact results prove the opposite. The US argued heavily for science to be kept out of the dispute, stating that it was a trade complaint and the safety of GM foods was not at stake! This is ironic since GMOs are tantamount to chemical weapons of mass destruction which have already devastated farmland in California and India.

Unfortunately GM products take away consumer choice, make farmers dependent on big business and undermine food security in developing countries. Furthermore, nobody knows what risks they pose to people's health and the environment. Since the launch of the dispute, the European Commission has already kowtowed to US pressure and approved five GM crops despite scientific uncertainty and potential environmental and health problems. The European Commission also attempted unsuccessfully to overturn bans on GM food and crops that Austria, France, Greece, Germany and Luxembourg put in place to protect its citizens and the environment. On 24 June 2005, Environment Ministers from across Europe voted to allow countries to keep their safety bans on genetically modified food. On 29 November 2004 the Commission had already tried (and failed!) to end those bans. The rejection to lift the national safety bans by the member states showed that the countries want to keep their sovereign right to ban GM food and crops despite WTO pressure. (For more info see here and here.) Indian Ecologist Vandana Shiva said: "The transatlantic trade dispute shows the worst face of the WTO. Despite the fact that the UN Biosafety Protocol allows countries to use the precautionary principle to ban the import of GMOs, the WTO may force feed us GMOs".

Activities, Books and Gatherings

I had a new experience in December - single parenthood! Well, not really new but being the single parent of four children for nearly three weeks was a great experience. Because I decided (based on past experience) that when they are about (eg not at school or asleep) I must focus on them, it allowed me to develop a better feel for what they are up to and what is going on in their minds. It was a very positive therapy for all of us and I recommend fathers make an opportunity to do the same - make sure you're actually involved rather than treating it as a holiday. I would do it again and would have continued if they were not so fond of their mother.

Work on a couple of exciting transactions proved interesting and we hope to help develop a couple of new businesses in 2006.

My brother's training business You Turn ("you turn your life around") is poised for an exciting year as blue chip clients sign up for programmes. Based in London, UK they offer one hour courses in basic skills such as plumbing and electrical ("Home Turn"), car use ("Car Turn") and living ("Health Turn") and are popular with companies as perks and with individuals starting out on the home ownership ladder. We wish him all the best with this great initiative.

Garden chores were somewhat neglected because of the additional load indicated above, but winter is a quiet time and catch up will be feasible. Activity in the garden is already picking up as buds are spinging in to action and early sowings will take place soon. If you are interested in our garden/yoga news please let me know or sign-up for Ballin Temple's short newsletter here (please scroll down to select newsletter signup).

Another couple of Pratchett's were devoured. Interesting Times has always been a favorite of mine because it takes place in an "oriental" setting so resonates with the decade I spent in Asia. It is also a story of repression and rebellion so much of the philosophy and commentary is relevant today. Such as: "Most people develop their social conscience when young, during that brief period between leaving school and deciding that injustice isn't necessarily all bad, and it was something of a shock to suddenly find one at the age of sixty." Masquerade is built on the Phantom of the Opera and is a fun "who done it?" It also has its share of philosophy relevant to local and global troubles of today: "The dwarfs think a rat is a good meal which only goes to show it would be a strange world if we were all alike!" or "The trouble is, you see, that if you do know Right from Wrong, you can't choose Wrong. You just can't do it and live."

I'd like to recommend the Ecologist magazine again. December's edition researched a couple of interesting stories - the contention that bird flu is emerging because of poor living conditions, and Irina Ermakova's GM experiment that suggest significant liklihood that consumption of GM product can have disastrous effects on their progeny! Its a great read with interesting features, like its analysis of avian flu, and provocative regulars, like Behind the Label its review of commonly used household products. It also offers an ethical living guide packed with exciting tips.

The only gatherings we attended in December were of the party variety. It was a wonderful time of joining up with family and friends and only wish we could spend more time with more of you.

We will be running a two workshops in 2006 - one focused on holonics and integral systems suited to executives and another more broadly based experiential retreat. For more information please contact me by email or + 353 59 9155037.

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.