Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

April 2006

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities, Books and Gatherings

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

It is spring in the temperate climate of the northern hemisphere. Blossoms scent the air and foxes are trying to eat our chickens! On the other side of the planet autumn must be showing its face with the colouring of leaves and slow down of vegetative growth. It is a time of change in nature. It seems too, that our metaphysical world is facing great change.

San Francisco commemorated the April 1906 earthquake. Today, slipping tectonic plates can cause disasters, like the Tsunami of December 2004 but the disasters that will hurt most are those manufactured by human society. Our Investment and Finance review raises concerns about increasing instability in global financial markets - which is not recognised by prices in those markets. What is quite certain however, is that confidence and optimism are maintaining market buoyancy despite some serious imbalances, particularly in our global superpower. Perhaps one of the best ways to avoid a disaster is to predict it; so having just done that, we can be more comfortable that it won't happen! Nevertheless, it is increasingly important that people of privilege, like the wealthy and educated, like us all, become more aware of and responsive to natural and social imbalances.

Against this perspective of high imbalances, we found ourselves discussing opportunities for action with a range of professionals and friends. The way in which we choose to live and manage our business and assets depends first on whether we feel the pressure for change - usually the pressure to pay the rent or mortgage is more pressing, how we interpret our options - hedonistic or holonic, and how we believe the world works - simply of chaotically. Most of us will enjoy the status quo and profit from that. "Ockham's razor" will be quoted - the simplest answer is the right answer - and any passion to take on a challenge that might have motivated us in our 20s has dissipated as pragmatism has brainwashed our approach to fit in with the crowd we run with. Alternatively, we might believe that chaos and complexity science is the appropriate interpretation of the world and therefore seizing opportunity for change becomes the quickest way to achieve objectives, even if they are hedonistic.

I believe that our options span that spectrum of simple to chaotic dynamics - our options are "quantum". If we choose to follow the well trodden path we will win because if that path leads to the riches we seek we will be happy, and if it does not, we will be satisfied because everyone else is on it too. Alternatively, if we want to buck convention and follow emerging opportunities, as many entrepreneurs do, we will also be happy because, if we are successful we will be rewarded, and if we fail we will be consoled by the enormity of the challenge that we took on and the knowledge that others failed too. What is certain is that if you are reading this you are aware that choices are available and you must choose. What is also certain is that we will see the consequences of our choices before our children take on our responsibilities. The choices we make will create a world very different from today and we will see it unlike generations before us. Enjoy the ride!

Investment, Finance & V. C.

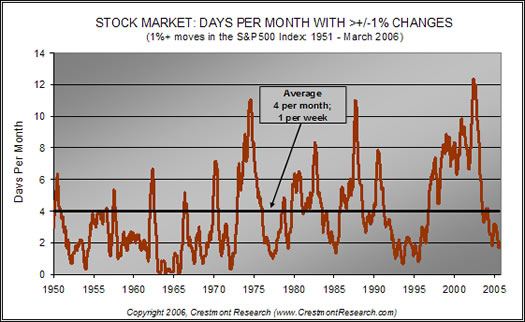

Readers may have noticed that we have not mentioned high stock

market volatility for some months. In fact volatility is at a trend low. Ed Easterling of Crestmont

Research has written a detailed analysis of stock market volatility

and its implications, pointing out that rising volatility in a secular

bear market (which we believe is occurring now - supported by higher

than long term average PE ratios*) tends to deliver negative

returns. The point of inflexion from low to high volatility is likely

to be close because volatility is currently at such a low level.

The technical trend turnaround may also be catalysed by macro economic

stimuli such as the quick change and high price of oil, house price deflation,

disintegration of WTO talks which is encouraging the promotion of regional

groups, terror fears in Iraq and on the nuclear front, and low confidence

in superpower administration. Be prepared for the downside.

As Easterling states: "It is incumbent upon investors to understand

the environment and to seek profit-oriented investments rather than hope

that the market will again provide the passive rewards that occurred during

the secular bull market of the 1980s and 1990s."

In fact volatility is at a trend low. Ed Easterling of Crestmont

Research has written a detailed analysis of stock market volatility

and its implications, pointing out that rising volatility in a secular

bear market (which we believe is occurring now - supported by higher

than long term average PE ratios*) tends to deliver negative

returns. The point of inflexion from low to high volatility is likely

to be close because volatility is currently at such a low level.

The technical trend turnaround may also be catalysed by macro economic

stimuli such as the quick change and high price of oil, house price deflation,

disintegration of WTO talks which is encouraging the promotion of regional

groups, terror fears in Iraq and on the nuclear front, and low confidence

in superpower administration. Be prepared for the downside.

As Easterling states: "It is incumbent upon investors to understand

the environment and to seek profit-oriented investments rather than hope

that the market will again provide the passive rewards that occurred during

the secular bull market of the 1980s and 1990s."

*On the subject of market price and value, it seems appropriate to review portfolios for the balance of risk and return. There is evidence that investors are paying for high expected returns but are discounting the risk associated with these businesses. While our data is not all encompassing, it appears that a significant number of analysts are reducing earnings estimates for companies they cover and commentators are suggesting that they aren't low enough. The robust PEs and the three year trend of double digit growth in quarterly earnings of the S&P 500 suggest that this criticism is reasonable. Over optimistic earnings estimates compound the risk investors face unwittingly. Analysis of US stocks suggest that businesses with lower risk are being over discounted, while higher risk companies (smaller, less liquid, less attractive valuations) are being bought. This seems to reflect the general consumer profile of "wanting it all and wanting it now"; investors' irrational exuberance is carrying them in to dangerous territory. We suggest that all our readers consider whether or not they fall in to this category.

It is fortunate that financial products can be used to manage risk. Hedging and insurance can be used to spread the cost among a wider population. However, this may obscure fundamental shifts in behaviour and contributes to the financial earthquake potential. The pressure valve is human ingenuity and the ability to change behaviour. Of course this needs to happen before the shock. Other sections of this month's Astraea Review highlight the natural imbalances that we are building from climate volatility to inequality of opportunity, which are invariably ignored by people in daily efforts to pay the rent. It is our contention that those individuals and businesses that redesign systems to reflect the holonic nature of our world will survive; others will fail.

The boom in hedge funds and hedged portfolio funds may serve to enable investors to manage risk. However, life is a zero sum gain - if there are winners there will also be losers. Our approach is simple, tending to avoid derivative instruments and preferring to invest directly. Nevertheless, investors should consider a range of options in managing the riskiness of their asset portfolios today. The potential for quick large losses is now higher than it has been since 2000.

While US growth is currently robust, the resources available to consumers to continue their binging are declining. In particular home equity leverage has been depleted and housing prices are stabilising which will have a significant impact on consumer liquidity.

In its latest analysis of global growth, the International Monetary Fund forecast that the world economy would expand by 4.9% in 2006, despite setbacks caused by recent natural disasters and fears over the surging price of oil. The prediction marks an upward revision of a previous IMF estimate for global growth in the region of 4.3%. However, the IMF warned that higher oil prices remained a risk to growth.

In the US petrol prices are rising, as are mortgage rates, house prices have started slipping, the automobile industry is weak, and incomes have barely kept up with inflation for most people for 4 years. Despite troubles the US economy is showing signs of strong growth, with personal and business spending strong. Forecasters expect that the economy grew at a rate of around 5 percent in the first quarter, the biggest increase since 2003.The expansion appears diversified from traditional growth sectors like autos and housing as, in the last year, hospitals, doctors' offices and other health care employers have created almost 300,000 jobs; restaurants have added 230,000; and local governments, including schools, have added 170,000.

US retail sales, a key indicator because consumer spending accounts for two-thirds of the economy, recovered 0.6% in March after the drop of 0.8% seen in February, according to Commerce Department data. Retail sales had jumped 3% in January when unseasonably warm weather had helped lure people into the shops. Analysts had feared that rising interest rates and energy prices and a cooling housing market were beginning to curb shoppers' enthusiasm. It was a good month at the cash tills for car dealers, furniture stores, building and garden centres, sports shops, book and music sellers and health and beauty retailers; business was weak for electrical stores and petrol stations. Total sales for the first three months of the year are now 8.3% up on the same period of 2005.

Americans seem to have noticed the boom, too. Although polling suggests that they are deeply unhappy with the war in Iraq and worried about the price of gas, they report being generally pleased with the state of the economy. The well-known index of consumer confidence by the Conference Board has risen to its highest level in four years, and in the most recent CBS News poll, conducted last month, 55 percent of respondents rated the economy as good, even though 66 percent of Americans said the country was on the wrong track.

Surveys show that many professional economists and ordinary Americans expect economic growth to slow in the rest of the year. Higher oil prices will effectively shift some money from the United States to the Middle East and elsewhere, and higher interest rates will make it more expensive for businesses and households to borrow. But for now, the economy is on a fast track. The fact that interest rates remain low, despite the Fed's rate increases of the last two years, is a big reason. The average rate on a 30-year conventional mortgage was 6.3% last month, lower than at any point in the 1970's, 1980's or 1990's, according to the Fed.

In parts of California, Florida and the Northeast - places where home prices soared in recent years - houses are no longer being snapped up, and many appeared to be selling for less than they would have last summer. But the housing market is still healthy in much of the country.

Perhaps the discrepancy between data and sentiment is occurring because GDP accounting only measures the total value of market transactions and makes no distinction between transactions that add to or diminish well-being. In short, costs are not separated from benefits.

The Economist pointed out that the principal driver of economic growth today is not China, India or the internet, but women. Girls may now be recognised as a better investment than boys in a world where brains is more valued than brawn, which may be provided by machines. Girls get better grades, and in most developed countries more women than men go to university. In the UK far more women than men are now training to become doctors. And surveys show that women consistently achieve higher financial returns than men do. The increase in female employment in the rich world has been the main driving force of growth in the past couple of decades. Those women have contributed more to global GDP growth than have either new technology or the new giants, China and India. Add the value of housework and child-rearing, and women probably account for just over half of world output. It is true that women still get paid less and few make it to the top of companies, but, as prejudice fades over coming years, women will have great scope to boost their productivity - and incomes.

Goldman Sachs chief Hank Paulsen has told UK staffers to decrease their willingness to finance hostile/unsolicited takeovers. He apparently is concerned that the practice is threatening certain client relationships. Rivals like JPMorgan Chase and Morgan Stanley also cited this threat when spinning out their private equity groups. This also comes at a time when analysts are questioning whether Goldman can maintain its leading returns without taking on the levels of risk that could hurt it badly. The concerns are modest because Goldman makes the bulk of its profit from trading and has a proprietary system that it envied by others. However, since the recognition of risk is coming from within, positive change is likely.

The European Commission would like to find some mechanism to ensure that all companies operating in the European Union pay corporation tax on a consistent basis right throughout the EU, irrespective of where these companies are deemed to be resident for tax purposes. The somewhat benign-sounding Common Consolidated Corporate Tax Base (CCCTB) is being discussed. Today, it is difficult to predict where all of this will end up, but the stated desire is to reach implementation by 2008. The issues are currently being examined by an EU working group which has been asked to bring specific proposals back to the Commission. As a business based in Ireland we note the concern that the Revenue here might have because many multinationals are based here because of low corporate tax rates and the benefits may be made redundant by the "CCCTB" and encourage the businesses to relocate.

Responsible Investing

“As we have now shifted from a “trust me” to a “show me” world in which corporations are the least trusted of institutions, banks should urgently adopt a reporting framework that demonstrates that they are actually implementing their policies in ways that make a meaningful difference to people and the planet.”- Shaping the Future of Sustainable Finance, WWF / Bank Track

Most American investors think that socially responsible mutual funds contribute to better corporate behaviour, according to a new investor survey conducted by Calvert . Knowing that a company is rated higher in terms of their social performance would make 71% of Americans more likely to invest in that company and 77 % would purchase more of their products and services. Socially Responsible Investment mutual funds influence companies the most in these areas, according to the survey:

| Product safety |

66% |

| Corporate honesty |

60% |

| Environmental safety |

59% |

| Fairer wages for employees |

55% |

| Reducing sweat shop labour |

52% |

| Hiring and promotion of women and minorities |

51% |

United Nations Secretary-General Kofi Annan and the CEOs of some of the world’s largest investment institutions launched the “Principles for Responsible Investment”. The principles will provide a global framework for integrating environmental, social and governance criteria into investment analysis and ownership practices and will align international investment practices with the goals of the United Nations, including sustainable development. The principles, which are designed for large mainstream investors, were developed in a nearly year-long process convened by the UN Secretary-General and facilitated by the UN Environment Programme Finance Initiative and the UN Global Compact. They identify a range of steps investors can take to integrate ESG issues in several areas, including investment decision-making, active ownership, transparency, collaboration and gaining wider support for these practices from the whole financial-services industry.

ISO has chosen SIS, Swedish Standards Institute and ABNT, Brazilian Association of Technical Standards to provide the joint leadership of the ISO Working Group on Social Responsibility (WG SR). The WG SR has been given the task of drafting an International Standard for social responsibility that will be published in 2008 as ISO 26000.

The "Social Footprint" method conceived by the Center for Sustainable Innovation for quantifying corporate social and environmental impacts uses quotients to compare company action to sustainability goals. There is no dearth of metrics to measure corporate social and environmental performance--greenhouse gas emissions reductions, or percentage of women and people of colour in the workforce and on the board of directors, for example. What is lacking, however, is a means to assess the actual social and environmental impacts of corporate action--in other words, the degree to which corporate social responsibility initiatives actually advance toward true sustainability. "The Social Footprint is the first non-financial reporting method capable of mathematically calculating the true bottom-line impact of an organization on society," says Mark McElroy, executive director and chief sustainability officer of CSI, in a report on the protocol. "While other methods, like the Global Reporting Initiative, do an adequate job of expressing top-line impacts, only the Social Footprint makes it possible to compare top-line impacts with actual human conditions in society, and thereby compute the social bottom-line of an organization." The basic concept behind the Social Footprint hinges on comparisons, expressed quantitatively in fractions, or quotients. For example, if a certain geographical region produces 10 million gallons of freshwater yearly (denominator) and humans in the region use 15 million gallons per year (numerator), then the quotient is 15/10, or 1.5. For a real-world example of comparing a company’s performance to a specific sustainability target, look at how Wal-Mart contributes to the advancement of the UN Millennium Development Goals, a set of eight aspirations to reach by 2015. CSI calculates Wal-Mart's performance as 0.10 for 2002, 0.12 for 2003, and 0.17 for 2004, far below the goal of scores above 1.0 for social quotients. The approach has already fostered discussion - a criticism of the Social Footprint by Mallen Baker in their recent newsletter may be found here.

The IFC has launched a competition to promote emerging market equity research into social and environmental issues. IFC is offering grants of up to $500,000 to research houses, rating firms, index providers and similar organisations to "support the development of new information services geared to sustainable and responsible investment in developing country firms". The Capturing Value programme is intended to "facilitate an increase in high-quality, long-term investment in emerging markets from pension funds and other investors worldwide," the IFC says. It notes that while socially responsible investment - broadly defined - totals some $2.7 trillion worldwide, only 0.1% of this capital is invested directly in emerging market listed equities, according to research it commissioned in 2003. The deadline for technical and cost proposals is 30 June, and the IFC says the competition is "open to a wide range of organisations, from mainstream sell-side analysts who want to deepen their expertise and product offering to more specialised firms that cater to socially responsible and ethical investors in the market". More information can be found by clicking here.

McKinsey has published a paper, When Social Issues Become Strategic, noting that case for incorporating an awareness of social and political trends into corporate strategy has become overwhelming. They say that issues such as privacy, obesity, offshoring, and the safety of pharmaceutical products can alter an industry's ground rules, and the financial and reputational impact of mishandling these issues can be huge. But they also create new market opportunities that nimble companies can exploit. They advise that companies should look for signs of emerging hot topics, be ready to respond to them early, and place a series of small strategic bets that will create value if the social and political landscape shifts. They note that CEOs must be willing to ensure that different parts of their own organizations are united behind a coherent approach, to engage in external debate, and to consider collaboration with others. These traits, however, a far easier to put on to paper than in to practice!

A new PricewaterhouseCoopers' report says companies will be driven by sustainable development in the next ten years. It identifies six trends that will encourage businesses to be more socially and environmentally responsible in the future. The PwC report "Corporate Responsibility: Strategy, Management and Value" recognises that environmental and social leadership will be essential to business success in the 21st century. The authors of the report see six major trends that will lead to greater commitment of industry and business to sustainability:

-

global markets will play a much bigger part than government policy in the decision-making process of companies, especially in the form of shrinking supply and growing demand for natural resources; labour and distributions costs or environmental and health legacies;

-

the financial model of current decision-making (in governments and business) will be revised to include new scenarios, new data and new risks; it will incorporate a growing number of intangibles and non-financial issues;

-

innovation will be key, but will be more than technological: changes in our behaviour, geopolitical structures and product design and development;

-

globalisation will diminish the role of the state; this will not be easy and sometimes driven by disruptions such as increasing pressure on scarce resources, changing patterns of global demand or growing awareness that we are a global community;

-

progress towards sustainability will be incremental , not revolutionary but specific catalysts may cause sudden disruptions and spurts of great change

-

the global media will play a big role in awareness-building.

Business Ethics magazine's annual list of the "100 Best Corporate Citizens" in America.KLD has provided research for Business Ethics since the inception of its '100 Best Corporate Citizens' list. Details about the 100 Best Corporate Citizens is available at: www.business-ethics.com/whats_new/100best.html.

Venture Capital

Korea is tightening its grip on foreign businesses, particularly successful ones. Government auditors in Korea announced that they are “shocked, shocked” to find out that there were alleged “irregularities” in the sale of the Korean Exchange Bank to Lone Star Funds in 2003. The Korean government fails to recognise that it sold the once-failing banking system to Lone Star to save it from collapse. Lone Star had completed a $6.7 billion sale of the bank to Korea's Kookmin Bank, just weeks before the Korean legislature was to enact legislation that would have allowed the tax-free deal to be taxed. That sale is apparently still on track, but Lone Star's ability to expatriate funds from the sale may be in question. Separately, Korean government prosecutors not only raided the offices of Lone Star in Seoul, but the homes of executives of the firm, as well as the offices and homes of Lone Star's affiliated advisors in Korea.

The activities of Korea's various prosecutions of U.S. private equity firms also extends as prosecutions and investigations of Warburg Pincus, Newbridge and other firms are now coming to fruition. And Korea's Financial Supervisory Service (FSS) has promulgated a new regulation that will allow it to “gather information” and monitor foreign-based investors in Korea more closely beginning in June. Specifically, the new rules allow regulators access to information about investments made by foreigners in Korea. The regulations also allow for information sharing with financial regulators in the United States, Hong Kong, Singapore and other countries. The new rules will allow access to “personal” information on investors or “anyone related to … deals” made in Korea.

Several important changes are taking place in China at the moment, including a significant reorganization of the Ministry of Finance and Commerce, an enhancement of the role of the State Authority for Foreign Exchange (SAFE) in private equity, and several other upcoming policy changes relating to private equity investments in China. Also,China's Ministry of Finance said this week that it will reduce minimum investments by individuals and businesses in private equity funds later this month. www.english.mofcom.gov.cn

We read the following comment on business in China on the Evian Group OWI forum and quote it here because of the realistic picture it paints of the risks of doing business in China. It is in relation to visa applications but illustrates the ingenuity of people with little to lose who want to improve their livelihoods but have no open opportunity to do so.

"One (long) anecdote. 1995-97, I served in China with the US State Department. Our neck of China "sponsored" upwards of 200,000 illegal Chinese migrants to the U.S. each year. With respect to students I have seen everything from fraudulent transcripts to fake bank accounts, to fake hukous, to fake diplomas. With respect to business, the fraud gets much more complex. After wading through piles of documents purporting to represent companies with legitimate business in the United States -- letters of credit, bills of lading, company ledgers, invitation letters, US "offices", tax returns, etc., we found the best way to combat this trafficking was to go barnstorming through southern China to personally locate the parent/sponsoring companies and interview personnel. Again, we found fraud at many levels: people who had embezzled from parent companies, had access to documents and computers, and created front companies to effect their migration to the United States; front companies set up entirely by snakehead smuggling rings; front companies set up by units of the PLA engaged in illegal business and needing an outlet for their revenues in the U.S.; "employees" who were actually brothers/cousins/uncles/sisters of legitimate employees who prevailed upon family to help them get to the states as an intracompany transferee; front companies for North Korean intelligence that found a lucrative side business in human trafficking; and front companies for Chinese triads engaged in other illicit business but needing a channel for people to move between southern China and the western United States."

US VC Q1 fundraising and investment activity seemed to be as buoyant as economic data. Q1 2006 VC fundraising was the strongest since 2001 or 2002 depending on whether you take the VentureOne/E&Y or MoneyTree figures by PwC/NVCA/Thomson VE. V1/E&Y reported nearly $6.02 billion 7% higher than the Q4 2005 total of $5.62 billion. MoneyTree, on the other hand, reported around $5.63 for Q1 2006. D iffering methodologies and timing of editorial accounted for discrepancies. We will tend to use MoneyTree since we usually report these.

Private equity fundraising had another very strong showing in the first quarter of the year with 93 funds raising a combined $31.4 billion, according to Thomson Venture Economics and the NVCA. 51 venture funds accounted for $6.5 billion of the total while 42 buyout vehicles raised $24.9 billion. While these figures show a decline from the fourth quarter, they are a significant increase over the first quarter of 2005. “For the venture capital community, this year will be the last in the typical three year fundraising cycle,” said Mark Heesen, president of the NVCA. “If venture firms continue along the current path of reason, we would expect to see a gradual levelling off of commitments in early 2007. First quarter fundraising was again robust but still within a prudent range. We have exhibited tremendous discipline in this cycle and that will serve our limited partners well.”

Venture dollars raised in the first quarter declined by 13.1% over the fourth quarter when 63 funds attracted $7.5 billion, but gained by 21.2% over the first quarter of last year when 59 funds took in $5.4 billion. On the buyout side the respective differences were more pronounced. This quarter’s $24.9 billion represents a 22.1% fall off from last quarter’s $31.9 billion, the largest amount of money ever raised by buyout funds in a quarter. However, this quarter outpaced by 76.8% the first quarter of 2005 when 49 funds raised $14 billion.

Fundraising by Venture and Buyout/Mezzanine Funds, 2002-2006

|

|

Venture Capital |

Buyout & Mezzanine |

||

| Year/Quarter |

Number of Funds |

Venture Capital ($M) |

Number of Funds |

Buyout & Mezzanine ($M) |

| 2002 |

173 |

3,931.9 |

88 |

26,153.5 |

| 2003 |

144 |

10,771.4 |

91 |

29,506.7 |

| 2004 |

195 |

17,900.6 |

135 |

51,784.6 |

| 2005 |

194 |

26,061.3 |

169 |

94,191.7 |

| 2006YTD |

51 |

6,531.9 |

42 |

24,875.1 |

| 1Q'05 |

59 |

5,387.9 |

49 |

14,064.8 |

| 2Q'05 |

57 |

7,684.2 |

60 |

26,369.5 |

| 3Q'05 |

58 |

5,454.0 |

59 |

21,824.2 |

| 4Q'05 |

63 |

7,535.2 |

46 |

31,933.2 |

| 1Q'06 |

51 |

6,531.9 |

42 |

24,875.1 |

Source: Thomson Venture Economics & National Venture Capital

Venture capitalists remained on a steady pace in Q1 2006, investing $5.6 billion in 761 deals, according to the MoneyTree Report. The quarter's dollar value matches the investment level from Q4 2005 and represents a 12% increase over the same time last year. Investments in Biotechnology overall declined 24% from Q4 2005 to $808 million, consistent with historical patterns of lower first quarter investing in the sector. The Media and Entertainment sector reached a four-year high, rising 80% over the prior quarter to $396 million going into 57 deals. Post-money valuations of Later Stage companies soared to a four-year high, with the average reaching $92.02 million for the full-year 2005 compared to $71.22 million in the 12 months ending Q3 2005.

Fewer companies received funding for the first-time in Q1 2006 than the previous quarter. A total $1.3 billion went into 219 companies, an 18% decline in the number of companies from the prior quarter. The decline echoes the rise in follow-on investing over the past several quarters as venture capitalists continued to nurture their existing portfolio companies to prepare them for a successful exit. Nonetheless, Startup/Early Stage deals continued to represent the bulk of first-time deals and dollars with 63% and 49% of the total, respectively, which is in line with historical norms.

Interest Rates and Currencies

Testifying before Congress Fed chairman Bernanke suggested that the Fed would soon pause its policy of steadily raising its benchmark short-term interest rate to weigh the impact of its two-year money-tightening. While he is counting on growth to slow to a more moderate rate, Mr. Bernanke said, "The economy has been performing well and the near-term prospects look good." However, building contractors and real estate agencies have been hiring more workers, a sign that higher interest rates are not yet really hurting the construction industry.

Although the Fed has signalled that a change in policy may occur , it is not clear when. We expect the base rate to be increased again in May and probably June but data on economic growth, consumer spending, inflation and housing in particular must be watched closely to gauge change in behaviour. Our estimate of continued rises to 5.75% by year end, with a pause in summer still seems appropriate.

On the currency front, the US dollar may come under further pressure to depreciate. While technically this ought to have been happening, intervention by central banks has slowed this down. However, in April a G7 meeting resulted in statements indicating that the support of the US$ is not such a priority. It also signalled further encouragement for the appreciation of the Chinese Yuan. We can therefore expect depreciation of the US$ over the coming quarters.

Trade and FDI

Efforts to liberalise world trade have suffered a setback, after large trading powers admitted that a self-imposed deadline of April 30th for preparing a deal on farm and industrial goods will be missed. Ministerial talks planned for the end of April were called off. Although more negotiations are expected in May and June, and there will be renewed efforts to get a deal by the end of July, there is every reason to be gloomy about the Doha round.

The deadlines were imposed because of the impasse in negotiations. But the deadline has slipped from December 2005 to April 2006 and now summer - there is no further room for them to slide and there is no progress. The American government’s Trade Promotion Authority, which forces Congress to accept or reject a trade bill without introducing amendments, is thought to be essential if America is to take part in talks. That authority expires in 2007 and few expect it to be renewed. Too many American politicians are once again turning protectionist. Congress only barely passed the Bush administration’s Central America Free Trade Agreement, even though its impact on the American economy will be tiny compared to the ambitions contemplated for Doha. And as it will take roughly a year to work out the finer details of any world trade agreement, the outstanding issues must be resolved early enough so the Bush administration can get a deal through Congress.Some observers suspect that Mr Bush’s team is worried, given already low poll ratings, that talk of removing agricultural protection could prove unpopular in some states ahead of mid-term elections this year. The chance for a significant deal on agriculture seems to have been lost.

The US administration has nominated Susan Schwab, who was Rob Portman’s deputy, to take over as head of Trade as a consequence of top level reshuffling by Bush. An experienced trade specialist, she says the American government still considers Doha and other trade negotiations matter greatly. Schwab is a competent technocrat. She spent some time in academia, and was on the staff of John Danforth when he was a Missouri senator. She joined the Bush administration last year as a deputy at the trade office. She doesn't have Portman's Congressional credentials, or Kantor's access to the president. Nor does she have Barshefsky's trade reputation or Zoellick's international clout.She takes the job at a time when global trade talks to reduce agricultural subsidies are floundering. However, she had extensive and highly successful career in financial services and this may help her catalyse movement.

If Doha does die, the focus of attention may switch to regional trade talks instead. But these are a poor substitute for global deals reached through the WTO; they may distort markets in much the same way as national protectionism. The EU has struggled to absorb its ten new members, for example seeing its services directive - which was supposed to free up trade in services the way the EU has already done with goods - considerably weakened. The prospects for regional co-operation in the Americas are limited. Several Latin American governments, like Venezuela and Bolivia, are now promoting a form of leftist nationalism that would not sit easily with wider liberalisation.

It is unfortunate that another major occurrence of greed has obscured science. India is cosying up to Monsanto despite the atrocious record of GMO in that country. The science and technology minister said that biologically engineered crops and pharmaceuticals are critical to the long-term economic and agricultural security of India a few weeks after he met with Monsanto and convinced the agricultural product giant to cut its royalty fees by 30 percent on genetically modified cotton seeds. There is no doubt corruption at work here - perhaps just a way of doing business in India, but not behaviour of which American companies should be proud.

Activities, Books and Gatherings

April afforded us some breathing room which was sorely needed to work in the garden as rising temperatures in the garden are bringing up the weeds as well as the seedlings. We also were able to make good progress on rejuvenating the long lost Victorian aqueduct in the garden. Our listed portfolios seem to be performing well, like many, which also afforded some peace of mind. The opportunity to reflect has raised the options of change which we'll consider more closely in May. There may be the opportunity to take on a partner so if you have a friend who demonstrates big picture thinking, professional skills and discipline and has high energy, please refer them to us - it is a good time to grow our activities.

Dipping in to Child Development by John Santrock reminded me what an excellent reference it is. It is very readable and offering practical understanding when you're not sure how to manage your children. Our copy is a 1994 edition, the issue coincident with arrival of our first-born, but remains timely and relevant. What's more, I find that it offers insights into my own behaviour! A highly recommended addition to a family library.

Carpe Jugulum by Dr Pratchett was on the bedside table this month. For most of the story I just enjoyed the colour and passion and then at the climax the big lesson for me came out. Don't try to beat your enemy, become part of your enemy to deflate its influence over you and then let it live to remind you of the dangers of evil. That might be common understanding for some of you, but I think it will be quite hard to do.

P3 Capital has arranged an investor's circle like gathering in early May in London which brings together ethically run businesses and investors. It promises to be an excellent forum and we encourage people to be in touch with Charlie O'Malley if they are either seeking to invest or raise capital because there are likely to be future events.

BeTheChange will

take place in the second week of May and we are looking forward to sharing

perspectives in science, business, art and spirituality at that forum.

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.