Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

June 2007

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities and Media

The following sections are delivered through Astraea. The links below will take you to those sections.

Perspective

What

would our world be like if humanity managed itself in an enlightened way?

It bears consideration because even enlightened change makers don't seem

able to present a vision that is realistic and attractive. At one

extreme we don't want to live in caves, at the other virtual luxuries

that we are greedy for are killing the planet and ourselves.

What

would our world be like if humanity managed itself in an enlightened way?

It bears consideration because even enlightened change makers don't seem

able to present a vision that is realistic and attractive. At one

extreme we don't want to live in caves, at the other virtual luxuries

that we are greedy for are killing the planet and ourselves.

The challenge is brought home by the seemingly unresolvable dilemma whose debate has risen to a crescendo in the past weeks: food versus biofuel. The world is waking up to the fact that fossil fuel consumption is wasteful and polluting even if it is a cheap accessible fuel for luxury. But has quickly realised that consumption of grain crops for the production of biofuel is raising the demand for food and thus prices so that scarcity seems to be arising.

Our big picture perspective considers that at the root is humanity's way of thinking. The global systems can be fairly described as being hierarchical, in a feudal sense, and, as discussed last month, the winners are those who subscribe to the golden rule (who has the gold, makes the rules) rather than The Golden Rule. It is clear that a hierarchical system is an appropriate step of enlightenment to a holonic intelligence. At the basic level of intelligence the drivers are simple survival values - food and shelter. Soon cooperation and organisation becomes essential to enriching intelligent life - chiefs and rules emerge. If a system continues to grow without developing additional intelligences, however, the organism (in this case the species) outgrows its habitat. This is where humanity is now. Although there are certainly pockets of enlightenment, as there have been throughout history, the massive growth of humanity's footprint in the last couple of centuries has been much faster than the general understanding of ourselves. While technology development has been rapid, development of culture and ethics has stagnated, even regressed. In general, we continue to subscribe to the might is right, the rich make the rules model of organisation. What would the world be like if individuals were not trying to be the alpha male?

What is more worrying perhaps is that an alternative way of doing things has not been envisaged by any of us. This leaves us therefore with only the two futures outlined: living in caves or a virtual world maintained by human technology. Neither can sustain the same population that we have today. That is not surprising because we know that the human population extracts more than the biosphere can supply by a factor of 3 or more. (This is an equation that is not greatly mutable by human technology since the common denominator is energy from the sun, which is finite. Today our utilisation of that energy is grossly inefficient as evidenced by the massive debt we are incurring by consuming millions of years worth of energy in our consumption of fossil fuels.

The future is here. The vision of the future can find a middle way. Your vision of our world is as important as any. Our thoughts make the world. Consider the rules of nature in imagining how we might live happily without degenerating in to a world of primitive or virtual infrastructure by necessity. Obviously, in the first instance we must consume less. This does not mean be less happy. It means thinking about what you eat and drink. The air that you breath. The number of houses you can live in. The amount of time you spend "working". The rule of enough is a great guide - enough is enough! The Golden Rule must also be lived by us, especially those of us at the top of the pile. This has scientific rationale as well as philosophical certainty. If we empathise with those around us it is difficult to compromise on ethics and happiness becomes the norm.

Investment, Finance & VC

The US economy grew faster than expected in the first 3 months of 2007, but showed a slowdown from the final quarter of 2006. GDP slowed to an annual pace of 0.7%, down from 2.5% in the previous quarter. Analysts had been expecting annualised growth of 0.8%. Consumer spending remains the main driver of economic growth, rising 4.2%. The housing market continues to weigh on growth, with investment in new home building down by 15.8%.

Long

term relative valuations, as common

sense suggests, are a broad predictor of expected return. See

the article shared by John Mauldin here. Currently prices are

high, so do not buy assets indiscriminately.

Long

term relative valuations, as common

sense suggests, are a broad predictor of expected return. See

the article shared by John Mauldin here. Currently prices are

high, so do not buy assets indiscriminately.

Estimates of the impact of the sub-prime lending meltdown are now up to $ 250 billion (a quarter of a trillion dollars). That is a big number. To get a frame of reference it is between 1 - 2 % of US GDP and half of annual GDP growth. The exposure may be asset rather than income based, but because of the high credit profile of US consumption, the impact could be devastating. The slowdown will be painful unless the extravagant consumption culture changes quickly, which is unlikely, as the report below on young Americans spending culture shows.

While we highlighted the problem of subprime loans in February 2006 and

markets didn't start to suffer till a year later, it is only very recently

that rating agencies have started

to do the numbers on exposure. The inevitable revision of ratings

is taking place and this will have a knock on further up the quality spectrum,

as has happened in Bear Stearns' hedge funds. Bear Stearns is planning

to give $ 3.2 billion (may be reduced) in loans to bail out one of its

hedge funds that has lost money in the sub-prime mortgage sector.

It is offering the lifeline after the High-Grade Structured Credit Strategies

Fund got itself into difficulty after the downturn in the housing market.

What was also revealed in June, and may be more worrying, is that a similar complacency to that found in sub-prime lending, may also have taken place in the corporate sector. Corporate leverage is high, similar to consumer and mortgage finance, and Xerion Capital Partners has pointed out that not only does the leverage mirror sub-prime high loan-to-value ratios, but the terms have been compromised by "covenant-lite" deals and payment-in-kind notes. It is time to reanalyse the leverage of companies you may be invested in or lending to.

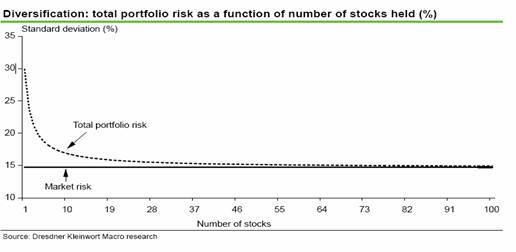

And

James Montier has published a useful review of the benefits of diversification,

and the cost

of overdiversification: the cost of monitoring and managing the portfolio

of very many stocks increases expenses and reduces efficiency without

enhancing risk reduction. Consider whether your portfolio manager has

too many eggs in the basket.

And

James Montier has published a useful review of the benefits of diversification,

and the cost

of overdiversification: the cost of monitoring and managing the portfolio

of very many stocks increases expenses and reduces efficiency without

enhancing risk reduction. Consider whether your portfolio manager has

too many eggs in the basket.

For a big picture discussion of where investment markets are going see Prieur du Plessis's Investment Postcards from South Africa and his forum Knights of the round table: mapping out the markets.

Optimistic teens may need a reality check about the world of personal finance awaiting them, according to the findings of Teens & Money, an annual survey released today by Charles Schwab & Co., Inc. Most teens believe they will achieve considerable success in the adult financial world, yet may not realize what it will take to achieve it based on self-reported knowledge and behaviour. Highly motivated by money, 8 out of 10 teens ages 13-18 agree that "it's important to me to have a lot of money in my life," and 73% believe they'll be earning "plenty of money" when they're out on their own. In fact, American teens confidently predict a future in which, based on the career that interests them most, they will be earning an average annual salary of $145,500 (boys expect $173,000 vs. girls, $114,200). The reality: Only 5% of the U.S. population currently earns a six-figure income, and the average national wage stands at approximately $40,000. When probed on the specifics of their financial knowledge, they reveal gaps that do not correspond with their confidence. For example, only 41% consider themselves knowledgeable about how to budget money and only 34% how to pay bills. They are still a big market: they spend an average of $19 in a typical week, with 59% making purchases online. They are more likely to have a cell phone (74%) than a savings account (60%). They are also in debt: although 88% "don't like the way it feels to owe someone money," 29% have incurred debt (close to $300, on average). With revolving credit in the U.S. (mainly credit card debt) steadily climbing to an average of $4,100 in credit card debt for every American over the age of 18, it is unlikely that the spending culture is going to change soon.

Responsible Investing

The theme in June seemed to be lots of talk of sustainability, but little action.

The trend to sustainable banking is demonstrated by the number of entries for the 2007 FT Sustainable Banking Awards, created by the Financial Times and the International Finance Corporation. The first awards in 2006 attracted 90 entries from 48 banks in 28 countries – creditable from a standing start. But this year, more than 100 banks in 51 countries have submitted 151 entries in the five categories, including many from Asia, Africa and Latin America keen to hone their sustainability credentials. Submissions show many banks now appreciate that sustainable banking is not just about avoiding the pitfalls awaiting the unwary lender. Increasingly, financial institutions see sustainability – including that of their own organisations – as a source of competitive advantage and a generator of profit and growth.

However, even mainstream magazine BusinessWeek notes the gap between what big players say about their sustainability and what they actually do: more green-wash than action. The commentary Black Marks For "Green" Banks highlights the difficulty mega corporations like Citigroup and HSBC have in moderating their own footprints, let alone aligning operations with ESG considerations. For example, drilling by mining company Lapindo Brantas Inc in Sidoarjo, Indonesia, triggered an unquenchable mud-flow in May 2006. Since then, 600 hectares of land - including 11 villages - have been submerged under a 150,000 m3 daily flow of hot mud. All efforts to stop the flow have failed, and the Indonesian government has ordered Lapindo to pay $435 million in compensation. As yet, the bill remains unpaid. Now, Friends of the Earth has turned attention towards the financial backers of the gas project, which include Credit Suisse, Barclays, Fortis Group, Merrill Lynch & Co and Natixis. It is unlikely that they will help, but it would be a step in the right direction if they owned up to their complicity in their "sustainability" reports and even changed their investment process (who signed off on the EIA?).

A report from the United Nations Insurance Working Group, made up of 16 insurance companies from around the world, offers new insights into how climate change, and sustainability in general, can affect the insurance industry. The implications go far beyond the insurers themselves. As risks grow, so does the cost of insurance, and companies unable to demonstrate that they are taking steps to mitigate risk will find themselves at a financial disadvantage. In some cases, they may be unable to get insurance at all. It's part of the new order: companies that fail to confront their environmental footprint may find themselves a step behind their more proactive competitors. Embracing environmental, social and governance principles across their operations is an essential element of building long-term company value. As our common environmental and wider sustainability challenges become clearer, whether it be climate change, resource depletion, environmental degradation or one of the myriad of other issues humankind faces, the insurance industry performs an increasingly vital role that helps us better understand the future, and face it with courage," writes Paul Clements-Hunt, the head of the U.N.'s Environment Programme Finance Initiative, of which the IWG is a part. "A robust insurance industry provides the thorough risk analysis and early warning system that allow informed choices to be made, businesses to prosper, and sustainable livelihoods to be built and flourish."

Among the many areas that would benefit from more activity by the insurance

industry, three areas in particular are most in need: providing micro-insurance

linked to microfinance; researching emerging risks and sharing the findings

with all stakeholders; and developing insurance products and services

for natural resources. They also identified two kinds of obstacles

that the insurance industry faces in widening the push toward sustainability:

structural barriers across the whole financial sector and barriers to

insurability. Misperception is one of the primary structural

barriers, mainly the preconception that environmental, social and governance

issues are irrelevant to operations, as well as the belief by some parties

that the profit motive and sustainability are incompatible. Additionally,

inflexible regulations in developing countries, the general weakness of

private financial sectors in those countries, and the vulnerability of

those people most affected by the issues at hand are seen by the authors

as other primary structural barriers. The barriers to insurability come

from both the supply and demand side, according to the authors, and include

the potential for catastrophic losses, poor data, lax risk regulations,

high administrative expenses and lack of consumer awareness.

The report offers five different strategies that will allow insurers to

become more fundamentally engaged with sustainable insurance practices.

The strategies are:

-

Knowledge of the risks faced. Research and analysis of the risks involved and how to manage them effectively is critical and may require special projects and the acquisition of new skills.

-

Public-Private Partnerships are promoted as an appropriate model for insuring ESG risks, particularly in developing countries and for catastrophic loss potentials.

-

Information Technology can be employed innovatively to measure risk very accurately, as well as allowing markets to be segmented and individual risks properly weighted.

-

Partnering with local organizations to help consumers understand the importance of planning for insurance.

-

Educating consumers through a collaboration with public sector and NGO partners.

More information is posted on the UNEP's Finance Initiative website.

Also, Eurosif's Insurance Sector Report, written with research provided by Bank Sarasin, states, "As the direct environmental and social impact of the insurance sector is comparatively small, a comprehensive sustainability management approach (including indirect impacts) is still lacking in most companies. However, awareness of current environmental and social risks such as climate change has grown." The report divides insurance sector into life insurance and non-life insurance. There are more than 5,000 insurance companies working in Europe, with €6.4 trillion under management. The ageing population found in most industrial countries is shaping the insurance sector, as there is more demand for life and health insurances. European insurance sector is facing stricter regulations and companies are establishing improved risk assessment and management procedures. Insurance losses from natural catastrophes and political activities have also been on the rise. The report considers one of the insurance sector's key challenges to be marketplace conduct, including lack of transparency and the large networks of independent agents that most insurance companies work with.

A new report from Mercer Investment Consulting prepared for the Social Investment Forum shows that one out of five workers already have a socially responsible option as part of their defined contribution plans. The report also says that the number of retirement plans offering screened funds is on the rise. In addition, Mercer released a new resource guide for defined contribution plan sponsors of companies that are interested in adding an SRI option to their retirement plans. The report, entitled "Defined Contribution Plans and Socially Responsible Investing in the United States," states that 19% of defined contribution plans surveyed now include a SRI option. Moreover, 41% of all plan sponsors surveyed that aren't presently offering SRI options are planning to within the next three years. Mercer's research was based on a questionnaire answered by plan sponsors, administrators, and consultants.

Consumer

health and nutrition is just one of the key challenges pinpointed by the

European Social Investment Forum's

new report on the European food production

sector. With 1 billion adults worldwide overweight, the report

points to the risks and opportunities food producers face in providing

healthier foods. Reports on the food production and insurance sectors

released by Eurosif join their earlier reports on the hotel and tourism,

chemical and automobile sectors. The Food

Producers Sector Report focuses on the "downstream" activities of

the food sector, which includes industrial food processing and packaged

foods. However, the report does not consider alcoholic beverages. The

report notes that four companies control more than 50% of the global market

capitalization of the top 30 global food companies. The top four global

food companies are Groupe Danone, Kraft, Nestle, and Unilever with all

but Kraft being European Union companies. Other key challenges faced

by the food production sector include the safety of food products, land

use, water shortage, labour standards, and human rights.

Consumer

health and nutrition is just one of the key challenges pinpointed by the

European Social Investment Forum's

new report on the European food production

sector. With 1 billion adults worldwide overweight, the report

points to the risks and opportunities food producers face in providing

healthier foods. Reports on the food production and insurance sectors

released by Eurosif join their earlier reports on the hotel and tourism,

chemical and automobile sectors. The Food

Producers Sector Report focuses on the "downstream" activities of

the food sector, which includes industrial food processing and packaged

foods. However, the report does not consider alcoholic beverages. The

report notes that four companies control more than 50% of the global market

capitalization of the top 30 global food companies. The top four global

food companies are Groupe Danone, Kraft, Nestle, and Unilever with all

but Kraft being European Union companies. Other key challenges faced

by the food production sector include the safety of food products, land

use, water shortage, labour standards, and human rights.

Concerns about sustainability are permeating the entire business world as consumers begin to seek out environmentally friendly products and urge companies to do more to lessen their impact on the planet. A study from the Grocery Trade Association takes an in-depth look at sustainable supply chain practices, and how they can benefit the bottom line of companies whose trading partners are requiring a level of sustainability in their purchases. The report uses Heineken, CHEP and Monsanto as case studies across a range of industries. The timing is right to incorporate best practices in supply chain management, the GMA/FPA argues, because not only do many of these practices increase profitability of companies, they also help the industry work with government agencies to shape regulations and build brand loyalty among consumers. The report looks at Heineken's guidelines for sourcing raw materials and reducing energy use in its production process, shipping company CHEP's program to pool shipping pallets among companies as a way to reduce waste in transportation, as well as how Monsanto encourages farmers to adopt conservation tillage methods that conserve topsoil and improve water quality.

Microfinance is being recognised as a successful bottom up intervention that has demonstrated that the poor can be served viably. Microfinance used to be known as a basic banking model for villages in the developing world, a universe away from the fast moving capital markets, private equity funds and giant banking and insurance groups that make up the dynamic modern financial sector. But the two worlds are now starting to converge. New horizons: creating value, enabling livelihoods by Forum for the Future takes a look at the growing interest in microfinance from both sides of the equation and confirms that the field is growing at an unprecedented rate. It also gives examples of innovations in products, processes and market mechanisms that are giving poor communities increased access to financial services.

However, while the investment climate, as well as the meteorological climate, is changing, most institutional investors are not changing their investment strategies, according to a survey of UK asset managers published this week. A lack of interest from clients, no clear regulatory framework and the long-term nature of climate change effects were the main reasons cited by the asset managers for their dismissal of the issue. Unless there is a specific and immediate event, climate change is not a central concern to asset managers, said the London-based HeadLand Consultancy in its report. One fund manager quoted in the report said: "We are not factoring climate change into mainstream investment risk because it is too long-term." Respondents defined long-term as three years. The researchers sampled the opinion of 19 asset management houses, representing £3 trillion ($6 trillion) of funds under management, in April 2007. According to the survey, there was little evidence of investment firms incorporating climate change in top-down investment strategies. Only specialist 'green' funds and investment houses that have a strong socially responsible investment policy are factoring in climate change issues. Most managers had recognised the risk that climate change poses to sectors such as insurance, power generation and transport – where the impacts are relatively clear and direct. However, there has been little in-house analysis of the potential 'winners' or 'losers' associated with this issue.

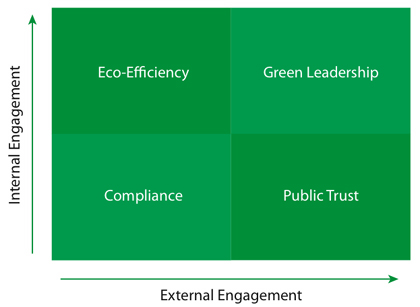

AMR

Research developed a Green

Leadership Framework, at right. The framework is comprised of two

axes of engagement: internal and external.

AMR

Research developed a Green

Leadership Framework, at right. The framework is comprised of two

axes of engagement: internal and external.

The lower left quadrant is relegated to issues of compliance. Green efforts

driven by regulatory and legal compliance include responses to initiatives

such as the following:

-

Facility compliance: ISO 14000 is part of a series of international standards on environmental management.

-

Product compliance: Includes legislation such as Restriction of certain Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE).

-

Health and safety management: Includes OHSAS 18001, an international occupational health and safety management system specification. For many companies, compliance is a collection of tactical initiatives.

Leaders, however, focus on more strategic engagement, both internally and externally. Internal engagement efforts tend to not only comply but embrace required compliance initiatives and view them only as a starting point to drive greater change throughout the organization. Internal initiatives target efficiency improvements with goals set at local sites and measurement systems providing a global rollup of corporate performance.

Many of the companies reviewed describe a journey of transformation, for some only recently begun while for others started decades ago when their businesses faced critical environmental challenges. For each of these companies, the journey can be characterized by four major stages:

-

Compliance: Being legally accountable isn't really an option, but as a director at a large chemical company explained, "compliance by itself is extremely expensive. You need to integrate compliance to be a minor piece in a broader framework of sustainability."

-

Personal commitment: In many of the leadership companies we visited, while past and present CEOs may have provided the initial enthusiasm, they also recognized the need for institutionalizing a philosophy of sustainability.

-

Public trust: Earning public trust is a matter of mitigating risk as well as increasing brand attractiveness. While public relations, marketing, and lobbying efforts are sometimes viewed as "greenwashing," executives in leading companies dismiss that label. Their response is typically, "Don't trust us, track us."

-

Sustainable growth: Besides being good community citizens, green business leaders are identifying opportunities to develop new green products as well as technologies that increase energy efficiency, reduce waste, and conserve critical resources.

The Sustainable Business top 20 is a must read for any ESG aware investor. This one issue is worth the annual subscription to Progressive Investor that is required. You can simply read the list if you like, but the report offers necessary detail and insight.

When the recent "Calvert Climate Change/Alternative Energy Survey" interviewed US investors, more than three-quarters of respondents expressed concern about global warming and its ramifications. Yet few investors have taken their concerns about climate change to their financial professionals, with only 20% of investors responding that they have considered investing in alternative energy. Notwithstanding the fact that few investors have moved their investments to alternative energy, most investors (85%) surveyed by Calvert think that investing in alternative energy is an opportunity to make a profit while helping mitigate climate change. Calvert, hoping to help investors put their money where their environmental concerns are, has recently launched the Global Alternative Energy Fund. Alternative energy sources are usually alternatives to fossil sources such as oil, coal and gas. Calvert's new Fund will invest in alternative energy providers (such as solar, wind, geothermal, biofuel, hydrogen, and biomass), the technologies that enable these sources to be tapped, and the services or technologies that conserve or enable more efficient use of energy. The Fund will invest at least 80% of its net assets in companies involved in alternative energy. Disappointingly Calvert's new Fund may consider companies that are involved with nuclear power, even though they will only do so if the companies are also working to develop renewable energy and if they meet Calvert's safety and security standards in the performance of their nuclear power operations.

Insight Investment published its first annual report on responsible investment entitled "Putting Principles into Practice". The report provides a comprehensive account of how Insight embeds analysis of corporate governance and corporate responsibility issues into its day-to-day investment operations, and how it encourages companies to improve their performance in these areas through engagement. The report coincides with the first anniversary of the launch of the UN Principles for Responsible Investment. The sixth PRI principle is ‘to report on our activities and progress towards implementing the Principles’. By publishing its new report, Insight hopes to demonstrate its full compliance with the PRI and to extend its longstanding commitment to transparency and accountability.

An annual survey of the French SRI market by Novethic reports that by the end of 2006 French SRI assets had risen 88% from 2005. € 16.6 billion are held in the French SRI market with 63% of these assets belonging to institutional investors. Mutual funds still hold the majority of the SRI assets; however, the survey showed that dedicated management for institutional investors is rapidly growing with € 5.6 billion in assets under dedicated management, a 178% increase from 2005. In 2006, employees of large corporations had more access to investing assets following SRI principles and took advantage of the opportunity with a 118% increase.

Why has the Toyota Prius enjoyed such success, with sales of more than 400,000 in the United States, when most other hybrid models struggle to find buyers? One answer may be that buyers of the Prius want everyone to know they are driving a hybrid. A good illustration of why building a track record of doing the right thing pays dividends.

A new report by Institutional Shareholder Services, the European Corporate Governance Institute and Shearman & Sterling, a law firm, examines the range and prevalence of legally available “control-enhancing mechanisms”, the use made of them by leading European companies, and what institutional investors think about them. A literature review carried out by the ECGI to underpin the study concludes that shareholders seem not to mind: although about 80% of big investors surveyed are opposed to CEMs, and typically apply a discount of between 10% and 30% to the shares of companies using them, they say they are happy to buy shares in firms provided the underlying investment case is sound. The report finds that newly listed companies use them much less often than established firms. In family firms they will probably endure, but for listed companies under increasing governance scrutiny they are likely to wane.

Leading SRI manager KLD has launched a blog: http://blog.kld.com.

Venture Capital

Private equity is being taken to task on both sides of the Atlantic. This time, though still couched in terms of envy, the criticism may have merit: that capital gains from equity pay should be taxed at the income rate (much higher) rather than the capital gains rate. This call has risen not least because of the highly publicised gains that Stephen Schwarzman is receiving for his shares thanks to Blackstone's IPO. (Floating a 13.2% stake in the company, the shares were priced at $31, at the higher end of forecasts, which values the company at about $ 33.5 billion, a 10% increase from the price China paid a month previously.) But the call has also been taken up by some leading lights of private equity like Ronald Cohen of Apax. In the UK five mega-firm buyout chiefs were grilled by members of the Treasury Select Committee, a hearing in one of a series, which will deal with issues like carried interest taxation and pension scheme guarantees. So far members of the BVCA were so embarrassed that president Peter Linthwaite resigned. There are very few bulletproof explanations for why mega-buyout firms deserve capital gains treatment for profits based on investment capital from limited partners, so the law may well change. However many VCs and mid-market buyout pros have made relatively persuasive arguments based on theories of economic development that their carry is equity investment. In fact, there has been talk that the BVCA may split up into two organizations, particularly after concerns were voiced that the group is being dominated by mega-firms at the expense of its less endowed peers. In the US, bills in Congress would change the provisions in tax law that allows private equity and hedge fund operators to pay lower capital-gains tax rate instead of ordinary top income-tax rate. These would end tax breaks that are skewing tax code in favour of most advantaged Americans. It would treat carried interest as ordinary income rather than as capital gains, except for capital contributed by firm employees/general partners. (You can download the bill here.)

While we recognise the benefits of VC and believe that equity investment should be treated as capital, we can not help feeling that the industry has become too greedy and this backlash of legislation is to be expected. We hope it will be a strong incentive for managers to reconsider the integrity of their investment structures and compensation schemes and encourage investors to demand more transparency and alignment from their funds and managers. Simple changes make a world of difference; such as paying salary in equity of the fund in lieu of performance fees and making the management company a subsidiary of the fund to ensure the manager is "straight" with investors. (You can see our model here: structure, operations and process.)

OpenAds, a London-based maker of a free, open-source ad server, has raised $5 million in Series A funding. Index Ventures led the deal, and was joined by First Round Capital, Mangrove Capital Partners and O'Reilly AlphaTech Ventures.

Whole Foods Market plans to sell all 35 Henry’s and Sun Harvest store locations, and a Riverside, Californian distribution center, to Smart & Final Inc, a Los Angeles-based food retailer owned by Apollo Management. The deal is contingent on Whole Foods prevailing in its current battle with the U.S. Federal Trade Commission, over its proposed merger with Wild Oats Markets.

Dreamerz Foods, a San Francisco-based natural foods company, has raised $10 million in Series B funding. New backers include Physic Ventures, Dean Foods Company and Fonterra Co-operative Group Ltd. Returnees include Burrill & Co., Great Spirit Ventures, Prolog Ventures and Unilever Ventures.

TerraPass Inc., a purchaser of carbon credits on behalf of its customers, has raised around $5.8 million in Series A funding, according to a regulatory filing. Backers include Maveron Equity Partners and Nth Power.

Sun Capital Partners has agreed to acquire the fabrics division of Interface Inc.. The transaction is valued at up to $70 million, including a $63.5 million up-front cash payment. The fabrics division makes interior fabrics and upholstery products for automobiles, and markets under the Guilford of Maine, Chatham and Terratex brands, and provides specialized automotive textile solutions.

Advent Solar Inc., a maker of solar cells and modules, has raised $70 million in Series D funding, according to VentureWire. ZBI Ventures led the deal, and was joined by Sun Mountain Capital, Globespan Capital Partners and return backers @Ventures, Battery Ventures, EnerTech Capital, Firelake Capital and New Mexico Co-Investment Partners.

Recurrent Energy Inc., a San Francisco-based solar panel owner and installer, has raised $10 million in Series A funding, according to VentureWire. Mohr, Davidow Ventures led the deal, and was joined by JEM Partners.

Imperium Renewables,

a renewable fuels technology business,

has filed with the SEC for an IPO which could see the company raise up

to US$345million. It is supported by a host of VCs: Attractor Investment,

BlackRock Private Equity Partners, Capricorn Management, Nth Power, Robeco

Private Equity, Silver Point Capital, and Technology Partners.

Mobius Power Inc., a battery

startup, has raised $4.3 million in first-round funding from Lightspeed

Venture Partners, Sigma Partners and Walden International. A regulatory

filing indicates that the company is raising upwards of $12.3 million.

ReVolt Technology AS, a Norway-based developer of rechargeable Zinc-air batteries, has raised €10 million in second-round funding. Return backers include Northzone Ventures, Sinvent, Sofinnova Partners, TVM Capital, Verdane Capital and Viking Ventures.

Biofuel Energy Corp., an ethanol producer, raised $55 million in its IPO, by pricing 5.25 million common shares at $10.50 per share. It originally filed to raise $300 million, by pricing 9.5 million shares at between $16 and $18 per share (later revised downward to $13-$14). The IPO gives BioFuel a market cap of around $340 million. It will trade on the Nasdaq under ticker symbol BIOF, while JPMorgan, Citigroup and A.G. Edwards served as co-lead underwriters. Shareholders include Greenlight Capital, Third Point Partners and Cargill Inc.

HgCapital has acquired a majority equity stake in UK wind farm developer RidgeWind. No financial terms were disclosed.

GigaCrete Inc., a Las Vegas–based green building materials company, has raised $5 million in first-round funding from Craton Equity Partners (f.k.a. Paladin Private Equity).

Bridges Ventures, a UK-based community/social investment firm, has closed its second fund with £75 million in capital commitments. BV was co-founded five years ago by Ronald Cohen of Apax Partners, Tom Wingh of New Look PLC and 3i Group.

UK research house Private Equity Intelligence (PrEqIn) has released some fund-raising data for the opening half of 2007. So far, 265 private equity funds have raised $260 billion, a 10% increase on the previous six monthly record of $237 billion in 2006 H2. For buyouts, US$116billion was raised by 67 funds, while 31 real estate funds raised $ 116billion, six infrastructure funds raised $ 18 billion, seven distressed debt funds raised $13 billion and 28 fund-of-funds raised US$16 billion. The results also reveal that fund sizes have continued to increase over the last six months: the average fund is now $1 billion, with 12 funds above $5 billion. The report also states that there are a record 1,090 new funds currently on the road, looking to raise a total of $ 552 billion. However, and as Preqin points out, only 26% of the new funds fund-raising in H1 2007 reached final close, compared to 45% during the second half of 2006.

Thomson Financial also released some data on the M&A market. H1 2007 saw a total of $ 2.7 trillion (yes that's 20% of US GDP) deals completed, a 62% increase on the same period last year. The US took a 41% share of the deals, with Europe in second place on 36%. Private equity firms were involved in 24.3% of all M&A deals in the first half of this year.

Thompson also released some VC data in conjunction with the National Venture Capital Association, revealing that 26 venture backed companies raised $ 4.27 billion through IPOs on US exchanges in the second quarter of 2007. This dollar volume represents a 112% increase from the same period last year when 19 venture-backed companies floated raising $ 2 billion. Venture-backed merger and acquisition activity declined with 67 transactions completed this quarter compared to 95 in the second quarter of 2006.

Interest Rates and Currencies

While central banks around the world are generally trying to tighten loose money, particularly as inflationary pressures are felt, the US Federal Reserve has left its main interest rate unchanged at 5.25%, saying it had concerns that inflation may fail to "moderate". It was the 8th time in a row that the Fed had left interest rates unchanged. The Fed is not alone in worrying about inflation, and central banks worldwide have been lifting borrowing costs. In the UK, the Bank of England has raised rates four times since August.

There was a significant drop in the price of US Treasury bonds in mid-June with yields on 10 year bonds rising from 4.96% to 5.2%. While a number of explanations may be made, such as the realisation that rates are not about to decline, the one that is most relevant is whether or not Asian central banks' appetite for US Treasuries is waning. As has been discussed previously (and see below), the rationale for Asian central banks to diversify is strong and there seem to have been initiatives to make that reallocation easier. If the trend continues, it will certainly put greater pressure on US policy makers.

As noted above in Investment, the US economy, the world's biggest, grew by 0.7% in the first three months of 2007, the slowest pace in four years and down from 2.5% in the last quarter of 2006. Also, there are growing signs that the higher rates are causing more borrowers to default on their mortgages. But the Fed said that the economy "seems likely to continue to expand at a moderate pace over coming quarters".

US consumption is robust as retail sales grew 1.4% in May, the highest in 16 months. Either there is more potential than data suggests or consumers are over-optimistic; we reckon the later is the case.

The data on inflation is not encouraging. By mid June the personal consumption expenditure price index, a measure of inflation, was 3.5%, while the "core" PCE index, excluding food and energy, was 2.4%. Food and Beverage was up 3.9% and energy was up 4.7%. During the first five months of 2007, CPI rose at 5.5% on a seasonally adjusted annual rate (SAAR). This compares with an increase of 2.5% for all of 2006. The acceleration so far this year was due to larger increases in the energy and food components. The index for energy advanced at a 36.0% SAAR in the first five months of 2007 compared with 2.9% in 2006. Petroleum-based energy costs increased at a 63.9% annual rate and charges for energy services rose at a 6.8% annual rate. The food index has increased at a 6.2% SAAR thus far this year, following a 2.1% rise for all of 2006. Excluding food and energy, the CPI-U advanced at a 2.1% SAAR in the first five months, following a 2.6% rise for all of 2006.

June was the first time I have read John Mauldin suggesting that a hard landing is a distinct possibility for the US economy. While it is not yet the most likely outcome, that fact that the perception of the possibility has risen, principally because of food and energy inflation, should be noted.

Consumer prices in Japan fell for the fourth month in a row during May following lower oil costs. The core Consumer Price Index for May was down 0.1% from a year ago. The data is unlikely to deter the Bank of Japan from raising interest rates from their current level of 0.5% by August because the economy does seem to be strengthening and in other data, the unemployment rate remained steady at 3.8% - the lowest level since 1998.

The

trade and currency tactics employed

by the US to shift blame for economic

imbalances away from Washington are not appropriate, as discussed last

month. For example, the US whining about China's

currency overvaluation is difficult to prove and not a coherent policy

as the Yen is more overvalued but ignored (see chart and linked

article). However, more practical limitations have come to light

as a range of Chinese exports suffer quality issues. Seafood, tires,

toys and toothpaste all suffered import bans or restrictions as contaminated

product was imported to the US.

The

trade and currency tactics employed

by the US to shift blame for economic

imbalances away from Washington are not appropriate, as discussed last

month. For example, the US whining about China's

currency overvaluation is difficult to prove and not a coherent policy

as the Yen is more overvalued but ignored (see chart and linked

article). However, more practical limitations have come to light

as a range of Chinese exports suffer quality issues. Seafood, tires,

toys and toothpaste all suffered import bans or restrictions as contaminated

product was imported to the US.

This is not limited to basic goods being exported from China - Chinese investigators found nearly 60 hospitals and pharmacies in north-eastern China have been using fake blood protein in patients' drips, which could be life-threatening for those already in a serious condition. What is noticeable is the seriousness with which China tackles these weaknesses in China's regulation of food and drug standards. The execution of the head of the Chinese Food and Agriculture ministry went ahead as planned. While action in western economies seems to be stymied by lobbying (as evidenced by the USDA permissiveness reported in the section on Holonics and LOHAS).

It should also be remembered that these natural market forces will help manage the healthy growth of the Chinese economy - the lower value added products, in which China has strong competitive advantage, will be forced to improve quality, depressing supply and promoting price, which will aid domestic and international balances.

Inflation is a concern in China, especially as food prices are rising at a ridiculous rate because of shortages, so calling for a revaluation of the Yuan is not likely to change policy. In fact, it is likely that China is managing a strategy to liberate the currency over the next couple of years. The following linked articles offer more analysis of the incentives to allow the currency to rise: FEER's China Should Speed Up the Yuan’s Rise and Let China's Yuan Float by Chen Zhao of Bank Credit Analyst.

While it is certain that the Yuan will appreciate, it is in fact already happening and this will underpin inflation in the west, which has benefited tremendously from being able to export low-end manufacturing to the highly efficient China. The appreciation will also benefit China as it will help reduce inequities domestically. It is estimated that an upward rise of the Yuan of 10% a year can be managed with stability. We expect this trend to be reached once China has rebalanced its foreign exchange reserves, which we expect to be seen within 2 - 3 quarters, especially because there are further reports supporting the proposition that China, and other Asian countries, are diversifying away from US treasuries. In April China sold about $ 5 billion of US government bonds and have continued that process of reallocation. Some of the diversification is to equity - but this may have complimentary strategies as well as assets diversification. For example, the Chinese stake in Blackstone, as well as being at half the IPO price a month before the IPO, gives an insight in to US financial operations that will influence other strategies.

Trade and FDI

The negotiations to try to secure a new global trade deal collapsed without agreement. Trade leaders from the EU, US, India and Brazil meeting in Germany failed to find a breakthrough on the long-delayed Doha round of talks. Brazil and India blamed the latest failure on the EU and US not offering enough concessions on agriculture. The EU and US countered that Brazil and India were not opening up their markets to Western manufactured goods. But we feel that the burden of duty is on western economies. As trade campaigner Joe Zacune said: "The collapse of these secretive trade talks is a good opportunity to develop an alternative approach to trade that works for developing countries and the environment." Unfortunately, proposals had been driven mainly by the EU and the US putting "commercial interests of their corporations before the needs of poor communities and their natural resources".

Trade specialists will be pleased to know that finally access to data, previously cumbersome and limited, is being published in an accessible form by the WTO, UNCTAD and ITC. World Tariff Profiles provides detailed data on bound and applied tariffs of the 150 WTO Members.

In a new web commentary from the Carnegie Endowment, Katherine Vyborny examines the evidence on Doha’s implications for Africa, showing that a range of models built by different economists agree on the fundamentals: a Doha round with no special provisions for the poorest will hurt Africa; but no round would be a loss as well. Sub-Saharan African countries would benefit from a development-oriented round that includes measures such as full duty-free quota-free access for their exports.

According to the EU Commission, the "unprecedented demand for minerals" in emerging economies such as China and India is placing increasing pressure on the global supply of raw materials such as copper, iron ore and zinc, all of which are crucial for many industries. In light of increasing global competition for scarce resources, they intended to give a "comprehensive picture of the current situation of EU industry's access to raw materials". With the exception of the construction industry, most EU industries are facing dwindling global supplies of raw materials. According to a Commission working paper Japan, the US, Europe and China compete on the world market for ores, which are becoming increasingly costly. Metallic minerals are also in short supply, particularly in Europe. In contrast, Europe is largely self-sufficient with respect to minerals used for construction, such as feldspar and gypsum. Commission Natural resources strategy DG Enterprise page on renewable raw materials.

Activities and Media

June became very busy as school holidays started and we find days are now more occupied with children than normal. Lots of fun and rewarding, but some of the chores can get delayed.

We also had a very special visit - our first from China! A good friend stopped by for a week so we enjoyed some real Chinese cooking and had first hand tales of life in Hong Kong at the 10 year handover anniversary.

The first harvest came in with broad beans, garlic and lettuce. If the weather would become a bit more summery the harvest would accelerate but so far it has been wetter than normal (as evidenced by floods around the world from US to UK to Germany to Pakistan to India to China!). The rain has also delayed our roofing project ... hopefully that will be remedied before winter!

On the book front, Daniel Goleman's Working With Emotional Intelligence is not as insightful as his earlier book Emotional Intelligence. It is a litany of case studies to prove a point. While interesting it does not offer the same insightful understanding that he might have tried for. As a management guide Maverick is much better and Goleman's perspective would be improved by combining his science with Semler's story.

Lots of links on the internet came to light:

An investment blog called The Big Picture caught our eye. Its light-hearted, wide ranging and insightful, though principally US oriented. You might enjoy Barry Ritholtz's spiel here.

A fun, illustrative, interactive presentation of world development statistics: Gapminder World 2006. And here is a lecture by Hans Rosling, an International Public Health prof., demonstrating these tools:http://www.ted.com/index.php/talks/view/id/92

A source of green research is AMR Research.

And if you enjoy online debates check out friction.tv a new website set up to promote free speech and uncensored debate, and soon to be co-hosting online debates with the Ecologist. In a world where people seem most interested in Paris Hilton’s prison exploits, it’s reassuring to see that a site as openly committed to raising the bar of debate has already had 250,000 people using it in its first three months - more than YouTube did at the same stage in its growth.

And By Kids For Kids encourages young

people to imagine, research, plan, and invent their own games and toys,

vying for honours in such competitions as the Mattel-sponsored "Invent-a-Toy

World Games." Winning toys in the 2007 competition include an indoor

campfire, complete with a recorder for capturing your ghost stories and

campfire songs; a waterworks building toy with real plumbing; and a game

called Xoomball that uses air pumps to puff Ping Pong balls into holes

on a

game board. The site isn't just for kids. It also offers guidance

for parents on encouraging their youngsters' creativity, as well as downloadable

curricula for teachers.

While the networks tussled over which would land the first interview with Paris Hilton after her release from jail, the upstart Web site TMZ.com, The Web Site Celebrities Fear, was breaking most of the news. Its quite funny and in the style of a glossy magazine.

Please forward this publication to associates, family and friends, print

it, and share it.

This is a publication of: Astraea, Ireland + 353 59 9155037 Subscribe

and Unsubscribe

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.