Cover

Notice

Directory

Definitions

Glossary

Slide Show

Executive Summary:

-Overview

-Administration

-Success Factors

Market Opportunity

Change Technology

Market Dynamics

Timing

Administration

Structure

Strategy

Subscriptions

Administration

Economics

Operations

Business

model

Overview

Infrastructure

Culture

Economics

People

Investment

Process

Overview

Dealflow

Initial screen

Target research

Verification & documentation

Monitor & advice

Exit

Listed investments

Decision making process

Appendicies

Business Model

*Example

Deal Flow Reports

*Initial

Screen Template

*Environmental

And Social Guidelines

*Strategic

Review Templates

*Financial

Review Template

*Due

Diligence Checklist

*Diagnostic

Tool – Questionnaire and Illustrative Graphs

*Outline of Investment Committee

Report

*EVCA

Valuation Guidelines

*Proforma

Fund Projections

*Parallel

Analysis Decision Making Model

*Memorandum

and Articles of Association

*Securities

Law Matters

*Taxation

Market & Geopolitics

*Summary

Findings of Global Economic Outlook (UNEP)

*Conclusions

of World Resources Institute Global Resources Analysis

*The

Future of the Global Environment – Analysis by UNEP/RIVM

![]() :

Example Fund Details

:

Example Fund Details

information dated 2004

Market Opportunity

The investment management business of GRI Equity involves risk management and asset allocation. Readers recognise the particular nature of GRI Investment's business and have agreed that they are suitably qualified to evaluate the risks. (Unacceptable subscribers) The Company itself is not regulated . Each investment is subject to the finance and securities laws, as well as other laws, relevant to the jurisdiction in which the investment is made.

Overview

Consumer behaviour, regulation and technology are catalysing market changes globally. Consumers demand value for money, sustainable products and services. Sustainable business models are sought by leading companies. The industrial landscape will have changed to sustainable systems within two decades. Investors in globally responsible businesses will reap attractive, risk adjusted returns.

GRI Equity is an investment vehicle to achieve superior risk adjusted financial returns. Our focus is on sustainable lifestyle products and services (LOHAS - lifestyles of health and sustainability), information, communication and management technology, education, energy, transport and waste management, while our investment policy in inclusive.

Recent turbulence in financial markets has removed "irrational exuberance" from the financial intermediaries and extravagant corporate boards, while liquidity has reduced concurrently. The funding gap in small and medium sized businesses is expanding and business cost structures are becoming more attractive. Many private equity funds active since 1998 are suffering depreciated portfolios and are inexperienced in managing during economic downturns. While concurrently innovation continues, market opportunities are great and long term financial intermediaries, like pension and insurance fiduciaries, seek diversified portfolios. Now is an excellent time to invest in private equity, particularly for investors with a long term investment horizon. (See "Now is the Time to Invest in Private Equity" by Invesco, in .pdf.)

Leading businesses of all sizes are adopting coherent, integrated management systems and cultures which improve performance and reduce costs. They are adopting strategies that build upon new efficient technologies which are demanded by customers globally. We invest with these businesses to help build tomorrow's world in a globally responsible way while achieving superior returns.

There is a critical mass of technology accumulated, especially in the last three decades, which is driving the emergence of new industrial paradigms responding to the need for globally responsible consumption. (Please refer to leading knowledge technology which clarify methods of managing complex systems including “a Theory of Everything” S. Hawking et al.; “chaordism” D. Hock et al.; anthrosophy R. Steiner et al.) Accepted wisdom is that current consumption trends will exhaust natural resources within a few decades. Consumption patterns are changing globally as people demand wholesome and authentic substitutes.

Consumption is now patterned on market systems rather than command systems: where once the king, queen, or emperor, or more recently the prime minister or chairman of the board, made asset allocation decisions, today millions of individual consumers determine the socioeconomic landscape. Globalisation of markets has been catalysed by the modern industrial landscape and consumption infrastructure: production, marketing, distribution, sales and service, globally. Millions of individuals are voting with their wallets today, for the world they want tomorrow. The information needed to make consumption decisions is available - disclosure of price/performance is required to a high standard, and offered by many companies to an even higher standard. Consumers rapidly assimilate value-for-money benchmarks and change consumption patterns if a lack of authenticity is demonstrated.

The market system is working increasingly efficiently as it evolves. Transaction costs are reduced by

-

good, free information, to enable comparisons

-

fair rules (e.g. polluters pay, "IASB rules" for all).

-

self-sustainability, i.e. reduce and ultimately eliminate externalities (pollution) in physical/industrial, economic and ethical/political spheres. (This is in fact a requirement of all closed systems like the biosphere.)

GRI Equity recognises the rising tide of eco-consumption evidenced by segment growth, regulatory development, multilateral focus and general media. Success in the new industrial landscape requires businesses to provide:

-

value for money product/service

-

disclosure/self-audit (so that third parties can determine that value for money is genuine)

-

cooperation (because competition while internally efficient is externally destructive and thus not sustainable - improvement and creativity, as always, is generated by innate passion, for example, Einstein created for the sake of creativity, not "to get rich").

These changes in demand patterns are fuelling high growth rates of globally responsible industries and businesses generally well in excess of the total market growth.

The asset management industry itself is changing fast. Asset managers that neglect their ethical responsibilities when exercising fiduciary control are risking the equity of their business. The profession is under internal and external pressure from stakeholder groups to adapt to rapidly changing market demands. The minimum standard of behaviour demanded by stakeholders (through governance and other laws) now requires high levels of disclosure, various qualitative screens including environmental, ethical, safety and others, plus the ability to coalesce the analysis into one decision. This is a challenge few individuals, let alone businesses, have any experience at doing. And this is against a backdrop of depreciated portfolios where the incentive to "cut corners" is high.

Market dynamics are being rapidly driven by governance and operating standards and by information and communication technology. Both increasing standards and technology are enabling consumers to make far better informed decisions and great improvements in operations across sectors.

We expect that the investment window for this opportunity will remain open for up to two decades, by which time it is expected that the industrial landscape will have adapted to the phenomenon and growth rates will have normalised.

And investment managers must know what to look for and how to select and manage investments. This requires an understanding of the market place and the future outlook, broad industrial experience and a flexible and diligent investment method, all of which is offered by ... GRI Equity.

Change Technology In Place

Background: Science Proves the Need and Provides the Means to Change Consumption Habits

A move to sustainable practices was seen in the 1960s and 1970s by a minority of individuals and groups. It was considered to be unnecessary and undesirable by the majority. Many claims of the need for change could not be substantiated because of the lack of focussed research and the leap in production and consumption in the 1900s made the option of changing behaviour undesirable. Change was effected on a small, discreet scale with some positive effect (e.g. the Green Revolution).

However, environmental concerns were raised at many levels and provided the impetus for research. Environmental science has grown rapidly as a field of study in recent years. It was rare to find a course defined as environmental science two of decades ago and study was a combination of other fields (e.g. biology, engineering and public policy). However, it is now represented by defined curricula and a growing demand. It is one of the leading academic growth areas and benefits from ongoing research in a range of disciplines.

In the 1960s and 1970s the supposition that human consumption was destroying the earth held little weight because evidence was inconclusive and incomplete. Concepts such as global management and the noosphere have only emerged recently. However, the volume of research and collected data from the last three decades provide a wide, deep and strong platform from which to draw conclusions and justify strategy.

A good benchmark for this field is the United Nations Environment Programme sponsored study, Global Environment Outlook 1997. This study was backed by over 2,500 scientists globally and concludes that life on earth is in danger of extinction. (GEO2 is underway.) The World Resources Institute offers a significant body of data also supporting the conclusion that human overconsumption has jeopardised life on earth. For a selection of data see Appendicies GEO Summary and WRI Conclusions and UNEP/RIVM Future Prognosis.

Broadly the scientific conclusions and accepted wisdom are:

-

The biosphere (planet earth) is the only natural habitat for homo sapiens (and can not be recreated by humans – biosphere 2 was a disaster).

-

The remaining lifespan of the biosphere previously measured in millions or billions of years is now measured in hundreds of years because of overconsumption by humans in the last 100 years.

-

Consumption patterns must change dramatically and now if the biosphere is to survive.

(Numerous references illustrating this global shift are available including multilaterals, MNCs, science, business etc)

Technology For Change is Established

Environmental science is only a small part of the body of research and understanding that has been documented in the last 50 years. All areas of technology have evolved at a similarly rapid rate, whether it is the understanding of atomic structures, the dimensions of the universe (even existence) or areas along the spectrum including human behaviour, mathematics, communication, information, biology and so on. The interdependence of areas of technology and systems is now accepted wisdom.

The volume of technology, the infrastructure for its application and its accessibility has now reached and exceeded a critical mass allowing phenomenal changes in human systems and global management practices.

While consumption patterns must and will change, the ability to maintain a stimulating existence for humans is possible. The direction of these changes is illustrated in the section above. The emergence of a global conscience, or noosphere*, has been coincident with the establishment of the Web which has catalysed market changes.

(*The noosphere is the global consciousness effected by the density of interdependent communication media accessible by most individuals globally. Remote, poor villages in developing economies have or are gaining access to mobile phones, internet, and media, as do bankers in New York. Change is increasingly effected by individual choices based on accessible information and technology more than top-down regulation.)

Technology Now Commercially Viable

The rate at which the cost of sustainable technologies halves is now measured in years not decades. This is because of the synergistic effect of related technologies and the increasing resources being applied to their development. This combined with examples of viable businesses using sustainable technologies indicates that the market place is at the "take-off" stage of development in the normal industrial development model and commercial attraction of technologies is high.

Market Dynamics

"sustainable development, there is no alternative"

Globally responsible businesses are becoming the principal economic contributors. The trends to globally responsible practices are growing faster than any other influences. We expect them to be mainstream within two decades.

The consumer markets reflecting globally responsible initiatives have been recognised in the past two decades with the first ethical and green funds being launched in the mid 1980s. In order to demonstrate the viability of these markets, quantitative and qualitative benchmarks are presented below for consideration.

Interested investors may contact GRI Equity to request access to further secondary research available in our library.

Below we briefly discuss sectors that are being most strongly and immediately affected by new sustainable technology and consumer demand. We also outline the emerging regulatory environment and the role of the Web and media.

| WWW media |

Global LOHAS Consumption

Consumption patterns have fundamentally changed over the last 500 years from command systems to market systems. We are in the last years of this evolution.

In the last 50 years individual consumer power has been demonstrated to be the constant, increasingly powerful force of change in business. The best example is Ralph Nader's role in encouraging consumers to voice their fair concerns and not be bullied by organisations that benefit from incumbent power - automakers have withdrawn products, states and federal government have changed regulations and large consumer multinationals have changed strategy because of calls for market equity.

Iraq offers the most striking visible example of individuals influencing markets today. Millions of individuals around the world voiced their concerns over particular states circumventing UN protocol, the result was a change in rhetoric and a postponement of military intervention by at least three months. Today, the global community is involved in the rebuilding of Iraq.

Today, consumers are heavily influencing geopolitics and economics, and the organisations that represent them are responding appropriately, or facing extinction. IT has been the principal catalyst enabling this final change from command systems to market systems. Technology now allows information and opinion to be globally accessible with virtually no transaction costs. The Web enables distributed individuals to collaborate at lower cost than individuals that are physically closer. So, product, price and performance information circulates rapidly. Credibility of information is built by reference to fundamental properties and third party evaluation, not only marketing by the vendor.

These signs indicate that the evolution from command to market systems has passed critical mass on a global scale and the likelihood of regressing to an oligarchical model of economics, politics or business has passed. Our business structure and methods are designed to suit this dynamic market model: coherent alignment of stakeholder interests, appropriate disclosure, Web integrated infrastructure, globally distributed executives with access to each other and common resources.

In following sections, we will list a number of consumption patterns and new information channels that have emerged over the last decade. We target businesses in any sector discussed as well as others. Dealflow is discussed in the chapter discussing our operations.

Consumption Patterns Are Changing Fast - Economics Now Values Natural Capital

Until the last few decades human economics was considered to be discrete from nature. It is now accepted wisdom that economics must and will include nature’s resources in its workings. The academic initiative has laid the ground for adaptation of global markets. Practical implementation has begun such as attempts to cost pollution and natural resource degradation or improvement.

Carbon pricing, waste regulation, emission standards and forest monetisation are examples of new value drivers.

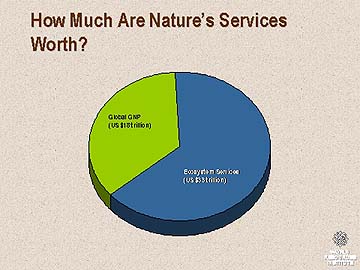

The magnitude of the anticipated evolution of economic systems may be illustrated by a benchmark study (by R. Costanza et al.) which has put a monetary value on the services provided by nature (but hitherto discounted by global economic systems). This indicates that natural economic systems are worth US$ 33 trillion compared to global GDP of only US$ 16 trillion. A summary by the World Resources Institute of this analysis is available at http://www.wri.org/wri/trends

From "Valuing

Ecosystem Services" WRI - ecosystem is 2x global GDP

Our confidence in the fact of this change is further supported by extensive secondary research. Much is available for review in our library. (Contact GRI Equity to visit the library.)

Consumers Now Value Environment and Ethics

Global consumption patterns are rapidly adapting as people choose to pay cash premiums for sustainable substitutes because the additional benefits exceed the marginal costs.

| More than 80% of the Americans polled in public opinion surveys agree that: ‘protecting the environment is so important that requirements and standards can not be too high and continuing environmental improvements must be made regardless of cost’. From Environmental Science - a global concern, by WCB/McGraw-Hill In the United Kingdom "50% of customers are paying attention to the social behaviour of companies". and "30% of the UK public has boycotted a product or company for ethical reasons in the last 12 months" - a MORI poll Q4 2002. Concern for the environment is viewed by many as a rich-country luxury. It is not. Natural and man-made environmental resources - fresh water, clean air, forests, grasslands, marine resources, and agro-ecosystems - provide sustenance and a foundation for social and economic development. - The World Bank |

In Asia, the consumption of beef is still below 1995 levels, the year before the BSE scare in the UK occurred.

A global awareness is growing, driven more by self preservation than beneficence. This is expected to continue as more information on the consequences of consumption becomes known to people.

Demand is driven by individuals, not rulers, prime ministers, CEOs etc and micro-technology, global access and efficiencies allow individual access to opportunities. And there are attractive opportunities in many areas: software and other IT, food, materials, eco-clean, bio-care, ...

Growth markets are driven by high consumers whose demand is shifting from convenience solutions to appropriate, considerate solutions. The consumption segment may be termed LOHAS or Lifestyle of Health and Sustainability consumption. It has recognised behaviour and is growing fast. Consumers are young at heart, educated and plugged in. They are young (at heart) - enthusiasm to conserve, reuse, recycle etc. They subscribe to “do to others what you want them to do to you”philosophy. They are educated - understand complex resource allocation issues locally and globally. They are plugged in to the noosphere – media, www etc for efficient, effective access to sustainable alternatives. And they are frustrated – tired of failure to disclose by incumbent suppliers.

Sustainable Business

Sustainable business is a globally responsible initiative. Few businesses would define themselves as sustainable yet it is clear that stakeholders' increasing demands are driving all businesses, and certainly leading businesses, to develop sustainability throughout their business: financial, market relationships, environmental. One of our favorite advertising tag lines is that of Shell, which has stakeholders globally:

"Shell on

sustainable development:

There Is No Alternative"

| Total Quality Management Extract from CIMA brochure on TQM. Many organisations, both public and private sector, have been characterised by: • a short-term

outlook; This can be successful if: • employees

are responsive to directions; However: • competition

and competitors are increasing; Survival is tough. Management is now finding that there is increasingly little room left for squeezing more from the organisation within its existing structure and philosophy and that any future gains will be increasingly modest. A more fundamental approach is required. This is what total quality management (TQM) provides. Extract from CIMA brochure on TQM. |

In order to succeed in a marketplace which is less inclined to give up tomorrow's consumption to have more today, businesses are adopting sustainable business principles and operations. From a business perspective, sustainable development encompasses three linked elements:

Economic: Profitability, wages and benefits, resource use, labor productivity, job creation, expenditures on outsourcing and human capital, etc. The economic dimension includes, but is not limited to, financial information.

Environmental: Impacts of processes, products, and services on air, water, land, biodiversity, human health, etc.

Social: Workplace health and safety, community relations, employee retention, labor practices, business ethics, human rights, working conditions, etc.

Achieving success in all areas is increasingly required to exist in the marketplace. This may be referred to as "Triple Bottom Line" accounting. Successful businesses are therefore adopting globally responsible initiatives to succeed.

Sustainable business models are built upon the market model, rather than a command model. Market systems (like nature) work better than command systems. The systems must be reactive and flexible, like neural systems. And the market may be improved by reducing transaction costs especially by

-

Good information

-

Fair rules

-

Self sustaining economics – lower externalities/pollution incl. physical, intellectual, ethical spheres.

| WWW media |

Information Technology

The development of information technology in the last few decades has enabled rapid low cost access, distribution, analysis and exchange of information globally. This phenomenon in particular has changed the opportunities available to consumers and businesses. Our perspective is to support development of a range of information technology related opportunities including computing, telecommunications, entertainment, education and media. In particular we like businesses that pursue open source, cross platform policies as appropriate.

from Apax Technology Review for 2003

The graphic above represents the overlap between technologies which computing facilitates. If this conception is expanded to focus on information technology (principally computing and communications) the web of interaction would be exponentially more sophisticated.

| The 7 Keys to Information Management Extract from CIMA Guide to Information Management 1. To understand business and how organisations operate in order to identify information critical to success. 2. To recognise that Information Management is the process of managing data so as to deliver information that adds insight, understanding and value for users. 3. To understand that Information Management is based on principles that remain applicable over time although techniques and technologies may change and that these principles are embedded in a core Information Management model. 4. To understand the different contexts, needs, perceptions, attitudes and motives of users in the way that information is applied. 5. To understand and be able to apply the range of techniques that can be used to provide information to meet the specific needs of internal and external users. 6. To be informed about and be able to select and utilise the most appropriate tools and technology from a well-designed form to the latest computer networks. 7. To be able to promote and maintain a broad and balanced perspective on how the organisation is moving towards and achieving its objectives. Extract from CIMA Guide to Information Management |

| WWW media |

Energy

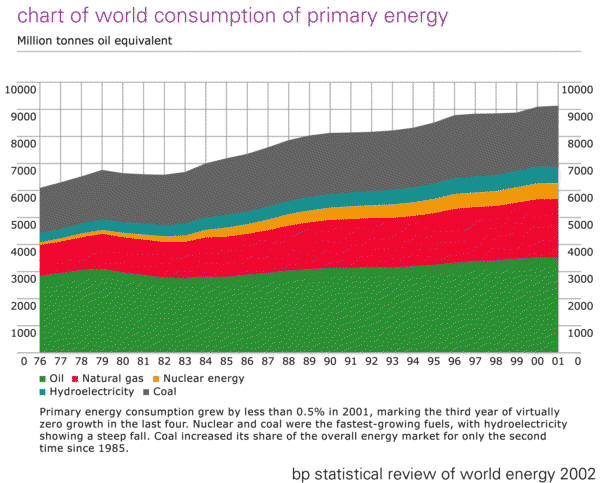

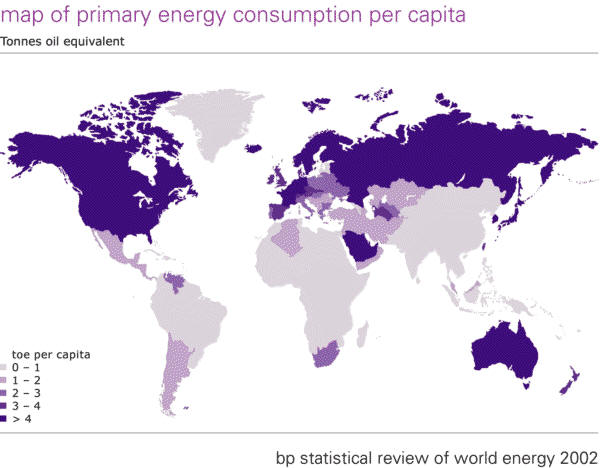

Energy consumption has increased rapidly and consistently over the past 100 years or so, both on an aggregate basis and a per person basis. Fossil fuels, in particular mineral oils, have been a catalyst of technological development and consumer conveniences (e.g. auto travel and air travel). Non-renewable fuel consumption has been a principal cause of degradation of the biosphere.

Energy markets are rapidly changing as energy production using renewable fuels is now widely available and increasingly commercially viable. Alternative energy technology production equipment cost is now close to or below US$ 1,000 per kilowatt, which is the cost of pulverised coal energy production plant. (Industrial gas turbines cost US$ 500 – 1,000 per kilowatt.) In particular, micro power is attractive in developing economies where the cost of the grid is an additional US$ 1,000 – 1,500 per kilowatt.

The commercial viability of fossil fuels is being challenged by the increasing cost of removing pollution caused by fossil fuels.

The market is also changing as it moves from centralised production and state control to distributed production and liberal markets. Micro production technology now allows economically viable energy production by hydroelectric, wind or biomass on suitable agricultural or industrial sites, with excess production being sold to the grid or unsatisfied demand being drawn from the grid. Energy exchanges, such as the EEX and CPX, pave the way for local trading of energy.

Initiatives such as the Kyoto protocol or zero emission laws illustrate the accepted wisdom that sustainable energy markets are an immediate goal, on global, national and local levels.

Sustainable energy sources have been available for several decades, but have never appeared economical. This equation is changing as fossil fuel sources become more expensive and alternative methods of energy conversion become more efficient and latent demand for them increases. Modular and scalable energy conversion systems are becoming economically viable.

A recent review of conventional energy markets may be found at www.economist.com/surveys/energy.

Nth Power (USA) estimate that alternative energy technologies will be a market of US$ 60 billion per year within a decade.

| WWW media |

Agriculture and Food

food is at root of our economic system because people die without food and water. The move to monoculture and genetic engineering is now recognised to be a mistake and unsustainable. Indeed it seems awkward to try rebuild nature so that we can transport and store fresh food longer?

Please browse The

Case for A GM-Free Sustainable World The Independent Science Panel (ISP) on GM - launched 10 May 2003 at a public conference in London attended by the then UK environment minister Michael Meacher and 200 other participants - consists of dozens of prominent scientists from seven countries, spanning the disciplines of agroecology, agronomy, biomathematics, botany, chemical medicine, ecology, histopathology, microbial ecology, molecular genetics, nutritional biochemistry, physiology, toxicology and virology. |

The excuse of big food companies for collusive behaviour (executive compensation, accounting irregularities, monopolistic industrial landscape, dominance of land in poor countries) is that they have been focusing on serving their shareholders is not valid anymore. The shareholders wishes have not been satisfied because the fiduciaries have not exercised their responsibilities. (See article on The Fund Management Industry by The Economist.) And consumers have been duped because we are ignorant of where our food comes from. This is all changing because as individuals we want to enjoy life, but not at the expense of other people's enjoyment of life. And because even our agricultural (monocultural) systems are not sustainable. Our consumption pattern is changing very fast.

Organic Food

The organic food market was not considered to be a discrete segment as little as five years ago. However, the shift in consumer sentiment has driven the establishment of focussed organic food businesses. This migration from boutique healthstore to high street is illustrated by the emergence of organic sections at major supermarket chains in Europe, North America and major urban centres globally.

Although production costs are higher than those for "conventional" agriculture, the energy input (excluding solar for photosynthesis) is far lower. As global economics tends towards the common currency of energy, the economic costs of organic production will become increasingly attractive.

Selected data indicate organic consumer market growth rates in excess of 30% per annum.

Health and Diet

A phenomenon of developed economies is that individuals will increase spending on food though volume remains the same. Businesses that deliver better food obtain value premia. Similarly the demand for complimentary health techniques and services is growing faster than the market for conventional health services.

A vegetarian diet has been adopted by a proportion of all populations for religious, health and economic reasons. In Western countries this had been a stable level of under 5% with moderate annual growth until the last decade. In the last decade, the shift to wholly or mostly vegetarian diet has increased pace and growth rates are measured in double digits as vegetable food sources substitute meat food sources.

Developing economies are increasing meat consumption to provide sufficient protein in the diet. Total food intake per person is well below developed economy rates.

| WWW media |

Materials Substitution

Although developed economy consumption appears to favour disposability and convenience this has in part been driven by the competitive need to differentiate product. As consumers realise the true cost of this they increasingly demand reduced packaging, recycling, reuse of materials etc.

In all industries the trend to substitution of materials from sustainable sources to replace materials from unsustainable sources is gaining pace. Several examples are:

-

Substitution of materials derived from fossil sources by materials from renewable sources e.g. wood derived products replacing plastic derived products including markets such as clothing.

-

The substitution of recycled/recyclable materials from conventional materials e.g. PET bottles, automobile components.

-

Reduction in materials use e.g. reducing consumption of disposable product and replacing this with reusable products (such as cloth shopping bags for plastic bags) or reduction in food packaging.

-

Redesign of systems to use natural resources more efficiently e.g. energy efficient buildings and natural homes or telecommuting is replacing centralised organisation.

These developments are driven by consumer demand.

| WWW media |

Waste Management

The cost of pollution is increasingly being recognised. We can see repricing of assets to reflect the fact that resource demand and supply is directly affected by pollution. Individuals and organisations at all levels are unwilling to accept the cost of pollution imposed by other’s consumption. Examples include industrial emissions, automobile emissions, consumer packaging, domestic waste.

Increasing commitment to managing waste is seen across global economies, driven both by consumer demand and regulation. Recycling programmes are becoming normal practice in developed economies and are being introduced in developing economies. Old practices are coming under increasing scrutiny, for example land fill management increasingly requires material screening and more considerate landscaping.

| WWW media |

Public and Private Regulation

Governance and Ethics

The standards of moral conduct within and by firms with respect to various stakeholders has become increasingly formalised in recent years. Employee, shareholder and community interests have raised the minimum acceptable standards of fiduciary responsibility for company managers. New laws or guidelines such as Sarbannes Oxley and independent benchmarking like the Global Reporting Initiative encourage and facilitate performance screening across qualitative functions as well as financial analysis.

Examples of unacceptable behaviour litter the media over recent months as the deflation of the asset bubble revealed fictitious assets. Enron, WorldCom, Tyco, Arthur Andersen, Ahold are some of the giants that have been shriveled by endemic corrupt business culture. Investors, whether pension funds or the pension holders themselves, are unforgiving of well paid investment managers investing in companies which are subsequently found to have been unethical, prima facie. And new guidelines and laws are ensuring that those in positions of power to allocate assets exercise appropriate responsibility or suffer appropriate penalties.

Environment

Supra national, national, regional, local and community administration places increasing emphasis on the requirement to eliminate public pollution (while at the same time private value choices are increasingly liberalised). Visible examples include the prohibition of smoking in public places in USA since the costs of passive smoking have been demonstrated, or increasing criminalisation of drunk driving, while private consumption choices are becoming increasingly varied. As the scientific evidence for destruction of the biosphere expands from the academic domain and spreads through the public domain, a similarly rapid regulated or unregulated shift in consumption patterns will occur .

As well as increasing public regulation, private organisations are increasing environmental self regulation Businesses and individuals invariably adopt the highest standards to differentiate themselves and regulation or guidelines will be below the standard of some operators. Three decades ago investment in developing economies was often partially predicated on the ability to operate to lower environmental standards (and therefore cost) than legal in the domestic economy, however, the investment policies of all institutional investors reflect the higher environmental standards irrespective of the standards of the host economy. Moreover, high value markets demand higher value products deemed to be conscientious; clean operations improve efficiency and raise the economic value added to the consumer.

Regulation of environmental impact of industry is increasing. Generally regulation is restrictive, requiring that pollution is not released by a production facility or that products fall within certain guidelines of environmental impact. Examples include, water treatment within industrial facilities, the requirement for low/zero emission automobiles or the recyclability of automobiles.

| WWW media |

The Web and Media

The TV, newspapers, music, video, film, radio have all been revamped by the impact of the Web. Affordable access to production of publicly acceptable media has catalysed the emergence of Pierre Teillard de Chardin's noosphere. Users of information get it cheaply in real time, producers of information can display or sell it as quickly as they can produce it. This phenomenon is particularly responsible for catalysing market changes: consumers vetoing beef for fear of BSE, world brands being attacked for abusing their market power, individuals being able to blow the whistle and survive and many other examples of how the Web and media bring us all together and enable people worldwide to act as one decision making unit on global issues.

Local and global media coverage of environmental industry and ethical business practices is increasing and raising public awareness of issues of global management. Principal issues appear to be global warming, genetically modified organisms in the food web, new diseases created from unsustainable practices (e.g. "mad cow disease"), human rights abuses (e.g. inappropriate wage rates or working conditions) etc.

Widely disseminated information on European food scares in the last few years have had a dramatic effect. In Europe consumption habits have changed radically, for example, German consumption of beef dropped by more than half in the week that cases of BSE were discovered in Germany! In the USA, although the US Food and Drug Agency has set a high benchmark for food disclosure requirements, the lack of a policy on genetically modified organisms became a national issue so that now US public policy is being upgraded.

| WWW media |

Asset Management Industry

Investment management is a principal influence on economic development. The capital market size is estimated to be over $ 100 trillion (~ $ 80 trillion in 1998). (This compares to world GDP of ~ $ 27 trillion (of which G7 ~ $ 19 trillion), world trade ~ $ 5 trillion and daily foreign exchange market turnover of ~$ 2 trillion). Players in the capital markets use debt and equity linked securities to trade opinions about the "true" value of assets. Derivatives are used to acquire and sell risk which has been segregated from the underlying asset. Of the segments within the capital markets, liquidity is highest in currencies (turnover > $ 2 trillion per day globally), whereas as the private equity market is relatively illiquid.

“In general...people are not terribly rational about the way they invest...so they are inclined to buy at the top and sell at the bottom, and they're not good at seeing how fees eat into their investment performance...I think that in the future, people will get better at investing their money, because they'll be responsible for their own retirement, which will make them pay more attention and put more pressure on the fund management industry ...” Tamzin Booth, finance correspondent of The Economist Survey

of the Fund Management Industry by |

Decisions over many individuals' assets (e.g. pensions, deposits etc) are concentrated in the hands of relatively few managers (via intermediaries like banks and pension companies). Intermediaries (long term financial institutions) are being driven to globally responsible policies by customer demand (savers demanding ethics) and by regulation (governance). Decision stakeholders include regulators, incumbents, public asset allocators, private investment managers, entrepreneurs, private investors, and, most importantly, individual savers.

The globally responsible investment market is a large, well established sector, growing fast. Total socially responsible investments in the USA was $40 billion in 1984, $639 billion in 1995, $2 trillion in 1999, or a compound annual growth rate of 30% per annum. This is ~ 13 % of the estimated $16.3 trillion under professional management.

Sustainability Investmentfrom the Dow Jones Sustainability Index website Increasingly, investors are diversifying their portfolios by investing in companies that set industry-wide best practices with regard to sustainability. Two factors drive this development. First, the concept of corporate sustainability is attractive to investors because it aims to increase long-term shareholder value. Since corporate sustainability performance can now be financially quantified, they now have an investable corporate sustainability concept. Second, sustainability leaders are increasingly expected to show superior performance and favourable risk/return profiles. A growing number of investors is convinced that sustainability is a catalyst for enlightened and disciplined management, and, thus, a crucial success factor. from the Dow Jones Sustainability Index website |

Incumbents in the asset management industry are adopting sustainable principles and products, such as Dexia, Societe Generale, Morley, ISIS, Henderson. The main markets are tracking this market as Dow Jones has introduced a sustainable index DJSI (see above) and the Financial Times has introduced FTSE4Good, both offering global coverage. Investment specialists have been established upon sustainable principles during last 2 decades such as SAM, Domini, Trillium, Impax, Calvert, Temima and GRI Equity. Ethical banks have been operating for many years now like Triodos, Cooperative Bank, Washington Bank and Grameen Bank. Business services and associations are also well established like Sustainable Business, Evian Group, Authentic Business.

The principal market is the US. GRI Equity views global opportunities in three main time zones: USA, Europe and Asia. Within each time zone (indeed within the USA) are different investment jurisdictions. We will consider investment in any country but will focus on larger economies in each zone and will seek out businesses particularly catering to LOHAS markets.

Principles of Sustainable FinanceFrom the London Principles of Finance interim

contribution to sustainable development. Economic ProsperityPrinciple 1: Provide access to finance and risk management products for investment, innovation and the most efficient use of existing assets; Principle 2: Promote transparency and high standards of corporate governance in themselves and in the activities being financed; Environmental ProtectionPrinciple 3: Reflect the cost of environmental and social risks in the pricing of financial and risk management products; Principle 4: Exercise equity ownership to promote efficient and sustainable asset use; Principle 5: Provide access to finance for the development of environmentally beneficial technologies; Social DevelopmentPrinciple 6: Exercise equity ownership to promote high standards of corporate social responsibility by the activities being financed; Principle 7: Provide access to market finance and risk management products to businesses in disadvantaged communities and developing economies. From the London Principles of Finance interim

contribution to sustainable development. |

Private Equity

The global investment funds flow is well illustrated by the global venture capital industry whose volume has dropped dramatically in the last two years to more normal historical levels.

Global venture capital funds raised and invested 1997

- 2001 (US$ billions)

Investment activity reflects global economics. Private equity Investment is concentrated in the USA:

All investment sectors are suffering from depreciated portfolios, which creates an incentive to seek inappropriate terms on new investments.

Private equity is turning to sustainable business investing. Although there have been few venture capital vehicles designed to target globally responsible businesses, it has been estimated by Nth Power (which targets alternative energy investments in USA) that venture capital investment in sustainable energy technologies has grown from zero to US$ 800 million between 1990 and 2000.

The following is extracted from Apax, a long standing private equity company, review of private equity 2002:

Private equity and social investment—financial transactions intended both to achieve social objectives and deliver financial returns to investors—make an odd looking couple. But social private equity offers a sustainable and profitable model of capital allocation to “under-invested” communities, and is already creating jobs and entrepreneurial role models in the United States. With the launch of the United Kingdom’s first community development venture fund in May 2002, social private equity is positioned to evolve into a new segment of the venture capital industry. - Sir Ronald Cohen, Chairman Apax Partners Holdings, Introduction of the Executive Summary of The Double Helix: Entrepreneurship and Private Equity.

Ethical Listed Investment Funds

Although ethical funds are generally operated to negative policies (e.g. they may not invest in arms or military enterprise) and for investment in listed companies only, the growth of this sector in the last three years has been exceptional. Growth in the volume of funds under management appears to be in tens to hundreds of percent per annum, because the market is coming from a low base and the demand for this type of product is high and unsatisfied.

Similarly, institutional investors are under increasing pressure from shareholders to observe ethical criteria in asset allocation as a minimum standard.

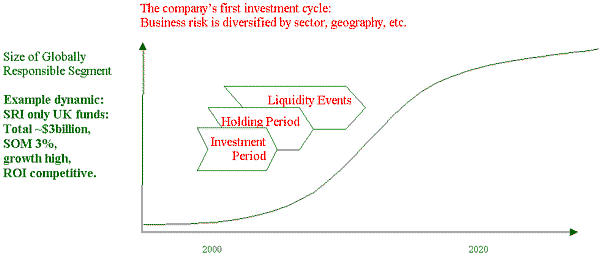

In the United Kingdom, socially responsible funds represent £ 3 billion out of a £ 800 billion of pension managed assets and have grown 100% in the last three years. Additionally, financial regulation and practice increasingly requires disclosure which is stimulating a more ethical approach.

We believe that an estimate of the global market of ethical funds of under 1% of assets under management and growth of over 30% per annum to be conservative.

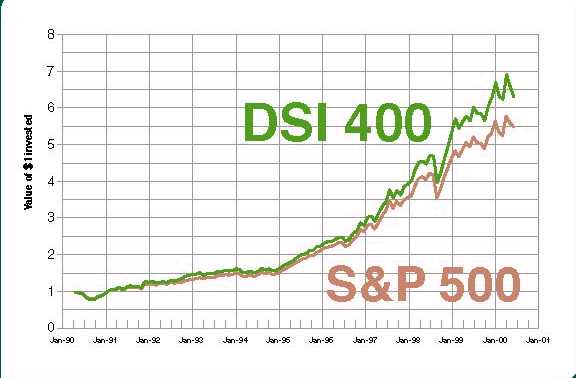

Early indications and market commentary suggest that returns on ethical funds appear to be competitive. One reason given for this is that more ethical and socially responsible management teams are inherently more successful. (This is a common observation of economies – that those which are less corrupt and more democratic are more competitive. See World Competitiveness Report by IMD and World Economic Forum.) Research by Dexia, Forum For The Future and Credit Lyonnais Asset Management indicate that returns are superior to the market.

The small universe of businesses makes it appropriate to target both listed and unlisted businesses today.

The Optimum Investment Timing Is Now

History suggests that the time required for a market to adjust to fundamental change (such as the commercialisation of personal computers) is one to three decades. Rapid diffusion of technology provides many commercial opportunities, but early established businesses that satisfy customer needs (value for money) survive the fallout which occurs when the industrial landscape stabilises.

An attractive hypothesis may be made: that a broad based investment portfolio of IT businesses acquired in the early 1980s would have provided the highest risk adjusted return if liquidated today. Similarly investment in globally responsible opportunities today is expected to provide the highest risk adjusted return if liquidated in a decade or so.

The Fund will be one of the first vehicles focused on this emerging phenomenon; though GR funds have been in the market since the mid 1980s it is only recently that regulation and broad market demand has turned the market focus to GR investing. The innovative stage of the industrial cycle is well underway and commercialisation is becoming established now. While globally responsible enterprise is now a small segment of the market, 10 years ago it was virtually undefined. We expect rapid development of these businesses to continue for the next one to three decades.

The time frame for investment by The Fund is designed to match the dynamics of this opportunity. Investing during the next five years will yield significant appreciation of enterprise value in the ensuing business or investment cycle. Superior rates of return will be achieved by maintaining a flexible approach to acquisition and liquidation of investments. The investment horizon is expected to be 5 to 10 years, while capital commitment may itself be 5 years.

The Fund does not propose to predetermine a liquidity event which might restrict the realisation of accrued enterprise value. Rather it will be the responsibility of the Board to review and recommend the timing of the final liquidation of The Fund. (Liquidation of Holdings remains the domain of The Manager.)

A pro forma timetable is presented here:

Conclusion

Scientific and market study provides the following:

-

Certainty that current consumption patterns are unsustainable

-

Human systems can be adapted to sustainable consumption patterns.

-

Technology to allow a natural, sustainable and enriching lifestyle for all humans is available.

-

Consumers change behaviour, often radically, based on new information. Consumption innovators (e.g. organic food consumers, sustainable energy consumers) have initiated the required change in consumption behaviour. The mass market will follow in the coming decade.

-

Substitution from traditional goods and service providers is occurring rapidly.

Investment in businesses catering to this market will benefit from:

-

Rapid market growth

-

Establishment of track record upon which to leverage growth in mass markets

-

Superior returns over lagging investors - the window of opportunity is now.

GRI Equity is well positioned to reduce investors' risk profile and achieve attractive returns. GRI Equity provides a flexible, transparent investment structure supported by a team of managers and associates that

-

understands these attractive market dynamics,

-

has proven methods to manage investment in these areas, and

-

has successful investment and operating experience in these areas.

go to The Company - structure, policies, terms

go to Management - methods, tools, dealflow, team

Home * About * Resources * Investors * Businesses * Members * Admin