Entrepreneur and Business Resources

Integral Methods and Technology

Governance and Investor Responsibility

archive

signup

credits

archive

signup

credits

Private and Confidential

January 2005

Our Review has been restructured to focus on Investment. Other sections are delivered through Astraea. If you would prefer to receive the Astraea review, please contact me. Thank you.

- Perspective

- Investment, finance & VC * Interest rates and currencies * Trade & FDI

- Activities, Books and Gatherings

The following sections are now delivered through Astraea. The links below will take you to those sections.

- Geopolitics * Risk and terror

- Energy * Climate Change

- IT

- Integral systems and LOHAS

- Activities, Books and Gatherings

Perspective

The

Coming Wave

Our principal commitment to walking the talk is hands on horticulture and conservation at Ballin Temple. In the last week of January as I was harvesting leeks an uncomfortable thought made itself known: we really do not care to invest in our health and well-being, but will spend on convenience. Most of us will pay a premium of 30% or more at the local store or for a packaged meal, irrespective of the industrial quality of the food, but balk at similar premiums for naturally produced fare. At BT we are lucky - those leeks are real food, delicious and not easily acquired by most people. But most of us are blind-sided into convenience and Super-Size diets. Commenting as a trade insider, even at the fancy restaurants often enough you will have processed and treated ingredients - taste the MSG!

As associates have pointed out "things are changing, people increasingly want to get real food and availability is increasing". But the realist in me doubts the intent of role models ."Its too difficult, complicated or costly" is often the refrain from people who make million dollar decisions and are paid many multiples of what the gardener earns. And when I see the expenditure on the Asian quake ($ 650 million) compared with the Iraq War ($ 250 billion), this perception of carelessness is reinforced. But we are lucky. Family and friends here are blessed to be able to enjoy the gifts of life. This has encouraged me to share our connections with nature. Therefore in 2005 I will help a group of seasoned personal coaches to deliver enlightening experiential retreats at Ballin Temple. I hope you too find time to breath fresh air, taste clean food and water and experience the fulfillment of being alive.

Investment, Finance & V. C.

Volatility is increasing in the US. We expect changing expectations of investment capital, economic sentiment, interest rate and FX to raise the short term risks in financial markets. Will it play into other markets? Certainly but there are negative correlations and there will be a dampened effect. Europe is insulated by having many diverse economies in the game, not one. Asia and South America are playing to different tunes - development. Africa just needs help.

In Europe, Germany's economy in particular may offer attractive opportunities. It is the biggest among the 12 countries sharing the euro and grew at its fastest rate in four years during 2004, driven by strong exports. Gross domestic product (GDP) rose by 1.7% last year after contracting in 2003. Concerns remain, however, over domestic demand and the labour market where there is the threat of job losses. The euro's strength against the US dollar is also a worry, and may dent foreign sales. But Germany is restructuring itself, including its culture and this is what makes it so interesting.

Are you ready for Sarbannes Oxley? Many practices promoted by governance leaders, such as formal board evaluation, expanded governance disclosures, and the use of independent, outside advisors, have yet to gain momentum. It seems that few large organisations have implemented the basic guidelines to promote sensible decision making and avoid conflicts of interest. However, it is evident that integrity is not a forte on Wall Street.

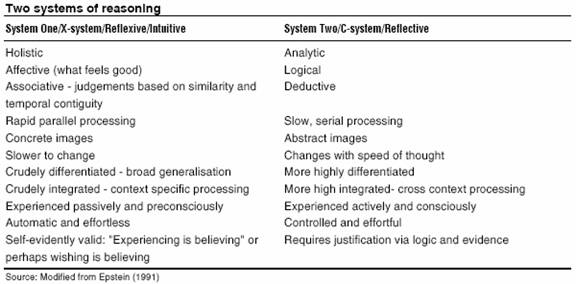

The report linked below summarises the sort of simple errors of investment that SOx is intended to mitigate and which can be avoided by diligent decision making process. The Psychology Behind Common Investor Mistakes a report by the AAII will help private and professional investors identify common errors made in volatile trading environments. A more extensive treatment (which we enjoyed) is Emotion, neuroscience and investing: Investors as dopamine addicts by James Montier of Dresdner Kleinwort Wasserstein - one of the revealing tables is reproduced below. (For an extensive thesis on risk and decision making process see Public Perception of Risk by Foresight of the Office of Science and Technology, UK government.)

The most exciting risk is a recession in the US. It may not hit this year but the harbingers will be seen. The market demand needed to pull it out of recession is not evident. The military expenditure must decline (although another $ 80 billion is being requested) as excuses evaporate and the culture of terrorism is rejected by Americans. Interest rates are rising and the rate of increase may accelerate. Currently we estimate one or two quarters of comfort but then uncertainty will begin to rock the markets.

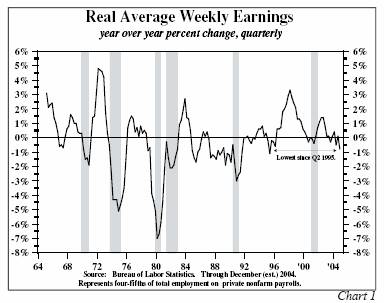

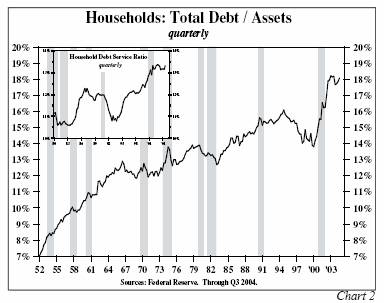

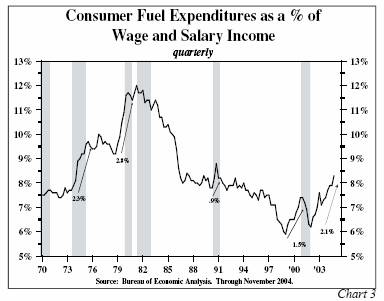

Our view of the US economy is rather sanguine. Rather than reiterate the causes related to personal, corporate and national leverage and the cost of money these charts tell the story. They are from Van R. Hoisington and Lacy H. Hunt, Ph.D at www.HoisingtonMgt.com and via John Mauldin at www.investorsinsight.com.

A more positive view is presented by Economic Cycle Research Institute (ECRI) which predicts economic performance from leading indicators. They have been comparatively accurate in their predictions and saw indicators improve in November and December.

Responsible Investing

The World Economic Forum and AccountAbility released a report entitled Mainstreaming Responsible Investing that discusses obstacles to more widespread inclusion of social and environmental factors by the investment community. The report also provides an extensive list of recommendations for systemic changes that could "tip" the mainstream toward more socially and environmentally responsible investment.

The UNEP Finance Initiative has published a report on the Materiality of Social, Environmental and Corporate Governance Factors on Equity Pricing. It includes sector studies and has the participation of bulge bracket players. "Environmental, social and corporate governance issues affect long-term shareholder value. In some cases those effects may be profound." (See the CEO Brief and the full report, both in pdf.) Another report, Who Cares Wins, discussing the connections of the financial community to the industrial world has been released by UNEP. Based on the Global Compact, it focuses on analysis, asset management and brokerage.

The Economist presented a survey on Corporate Social Responsibility. Unfortunately it was very disappointing. It is not recommended reading. Though it is not representative of the usual thoroughness of that group. It raised many of the problems of CSR. However, it demonstrated a lack of research in the area and failed to provide useful tools to manage business across multiple dimensions (eg financial control and risk, technology strategy, people management, operations) to improve performance. It failed to reference leading practitioners or practical examples. The principal issue appeared to be a blinkered focus on the item of profit, rather than value. Any owner/manger knows that profit is essential to survival but they also know that the value created and sought in bringing people and capital together in a business goes well beyond money. A current example is the tiny non-profit Mozilla organisation whose browser Firefox is better than IE (speed, security, ease of use, functionality) and is becoming the browser of choice having gained a 4.6% market share (almost entirely from IE) in only 6 months! Society also demands ethics in business - we are not prepared to allow criminal organisations however profitable. This sentiment is increasingly being reflected in regulation as well as investor engagement because businesses where ethics have been removed from the decision making process are destroying value even if they are profitable.

A summary of SRI funds performance in 2004 from Social Funds is reproduced here.

Venture Capital

The turnaround in (US) VC investment activity has begun, according to data released today by PricewaterhouseCoopers, the NVCA and Thomson Venture Economics. A total of $ 20.94 billion was disbursed through 2,876 deals for U.S.-based companies, which is a 10.5% increase over the $ 18.95 billion raised through 2,847 deals in 2003. IT dominated life sciences (63%-29%), as usual, with software serving as the largest sub-sector at $4.4 billion. Valuation benchmarks were about the same.

If you haven't seen the film Supersize Me you should - it is graphic illustration of why the wellness opportunities are ballooning. Venture firms pumped $ 234 million into obesity-fighting companies in the first 11 months of last year, 2.5 times as much as they invested in 2003 and more than 10 times as much as they invested in 2002, according to the MoneyTree survey conducted by PricewaterhouseCoopers, Thomson Venture Economics and the National Venture Capital Association. Ironically it's McDonalds that also supports this rationale. Their healthier menu has turned the company around in the last two years; one illustration - milk sales are up 26% at McDonalds in Ireland after introduction of organic milk!

Kraft plans to cut back on junk food advertising - products like cookies and sugary drinks - as part of an effort to promote healthy eating. The largest US food maker will also add a label to its more nutritional and low-fat brands to promote the benefits. Kraft rival PepsiCo began a similar labeling initiative last year. The moves come as the firms face criticism from consumer groups concerned at rising levels of obesity in US children. Major food manufacturers have recently been reformulating the content of some calorie-heavy products. In many countries (not US) TV advertising junk food to children is prohibited.

And it's not just North America. The British middle classes are eating more junk food and exercising less, according to new research from the University College London which was published in the European Journal of Clinical Nutrition. The new study reveals that up to one-third of Britons, around 20 million, have increased their consumption of fried foods and a similar proportion are taking less exercise. According to the study, the middle classes are eating more chips and fried food. Many have given up on wholemeal bread in favour of processed white varieties. Consumption of fruit and vegetables has fallen despite promotional campaigns. Around 40% of men and women were found to have increased or maintained their intake of fried food with the greatest rises seen in the educated middle income groups.

Venture capitalists will be interested to learn of the bloom in VC blogging where current views of practitioners are are shared. The VCJ article presents views of some well known venture capitalists. Venturewiki is an example of a nascent resource presenting valuable experience and views.

The excitement over hedge funds seems to have been overblown. Data from CSFB/Tremont indicate that they have under performed the S&P 500 and MSCI world indices over the past two years, only matching global bond returns. This is surely reflective of the excess investment in them.

Interest Rates and Currencies

We do not expect significant changes from the current trends. US interest rates will continue to rise and may accelerate soon. There may be one instance of faster increases than projected, but the rate of increase is unlikely to be accelerated any more. Economic performance will be modest thus inviting a less aggressive policy. With the FOMC talking about excessive risk taking we can assume that there is evidence for increasingly speculative activity in the market and this will encourage price volatility.

The US dollar will continue to suffer weakness with barely positive interest rates and a questionable economic outlook. European economies seem to be more resilient and the Euro is a less risky currency because it is diversified across several economies. Asian economies will get a boost from spending on recovery from the recent Asian quake and China is the top choice for FDI.

Trade and FDI

People talk a lot about China and we mention it regularly. Much of the talk is how it will impact global economics and when it will overtake the US in size. That will certainly happen and within one generation. An observation that has not been addressed is the different dynamic of Asia. It is certain that economies will all move toward market practice and politics will move to democracy, but what we expect is that China and India's expression of economic might will be far gentler than the US's because within the culture there still resides an innate connection with nature. Anyone who has experienced Chinese or Indian, in fact most Asian countries', culture will have recognised this empathy with family, nature and spirit. The food and way of eating is one of sharing not possessiveness for example. Natural remedies play a major part in well being. Family is important. Education is a priority. Western cultures have done little to reinvigorate their cultures but have allowed the popular way of life to focus on individuality, selfishness and supersized material consumption which the enlightened readers of this note will know are terminal. We certainly will not see any change from this course in the culture of our world superpower for some years.

China passed an important landmark in its evolution as a global economic power during the past year. It overtook the United States as the world’s leading consumer of most industrial raw materials and replaced Japan as the world’s second largest consumer of oil. China now consumes 22% of the world’s copper output compared to 16% for the United States. It will soon consume 21% of global aluminum output compared to 20% for the U.S. China produces more steel than the U.S. and Japan combined. China will probably produce 40% of the world’s cement this year compared to 6% for the United States. China’s explosive demand for raw materials has resulted from a variety of factors. The country has enjoyed several years of 7-9% output growth. Foreign firms have invested over $500 billion in China and will soon turn the country into the world’s second largest exporter. About 38% of China’s population now lives in cities compared to 20% in 1970. In 2030, China is projected to be 65-70% urban. When the U.S. urbanized during the first half of the 20th century, its per capita steel consumption increased six fold.

Despite the large rise in China’s demand for raw materials during recent years, its per capita consumption of commodities is still very modest compared to developed economies’. In 2002, China’s per capita consumption of copper was less than one third of America’s while per capita consumption of aluminum was only one fifth. It would not be difficult to imagine scenarios in which China could account for 35-40% of global metal consumption in 2025. China’s appetite for raw materials has already had a dramatic impact on the price of oil, copper, and iron ore.

China is a good place to invest. GM's profitability from China is 15x that of its North American business. GM and its Chinese partners had a combined net profit of nearly $875 million, or about $2,267 per vehicle sold in China. In North America, GM's net profit last year was only $811 million on sales of 5.6 million cars and trucks in the United States, Canada and Mexico, or about $145 per vehicle. That means GM China was nearly 15 times more profitable, per vehicle sold.

Poor People's Knowledge: Promoting Intellectual Property in Developing Countries highlights knowledge that poor people can commercialise. In doing so, it explores the ground that the WTO Agreement on the Trade-Related Aspects of Intellectual Property Rights (TRIPS) leaves uncharted.

In early January the U.S. Department of Justice fined Monsanto in connection with the company paying more than US $700,000 in illegal bribes to Indonesian officials, including $50,000 to an environmental ministry employee to forestall environmental reviews of the biotech company's genetically engineered (GE) cotton. However these payments did not lift controls on Monsanto's GE cotton in Indonesia, though they did result in criminal and civil charges against Monsanto in U.S. courts under the Foreign Corrupt Practices Act, which prohibits bribing foreign officials.

Activities, Books and Gatherings

We will be reorganising our activities as 2005 begins. Astraea group activities are growing in all areas and the client base is wide enough to allow us to focus on different needs. Astraea will continue to focus on Big Picture technology and services - developing expertise in integral thinking, research and coaching. Our investment focus will continue to be executed through GRI Equity. The expansion of natural business at Ballin Temple will provide a working model and a resource for Astraea. The principal impact for this roundup will be a segregation of commentary such that the GRI Equity Roundup will focus on investment while management technology and integral systems observations will be delivered through Astraea's online magazine. There will also be specific natural living examples delivered from Ballin Temple. You may opt in or out of the various channels of research and information.

Charles Handy's The Hungry Spirit must be recommended. Although it has been in print for 8 years it remains ahead of its time. It is particularly valuable to those of you seeking innovative business models. The time invested in reading it will be well rewarded. It is a wise practical manifesto for bringing social capitalism and economic capitalism together. He is a clear thinker with wide and deep experience who delivers his story in a modest way that will be appreciated by business leaders.

A recent Pratchett book, A Hat Full of Sky, was also enjoyed. It is aimed at children but is a story for us all. The main difference with his books meant for adults is that it has chapters and is "U" rated. Excellent.

This report has been prepared for information purposes and is not an offer, or an invitation or solicitation to make an offer to buy or sell any securities. This report has not been made with regard to the specific investment objectives, financial situation or the particular needs of any specific persons who may receive this report. It does not purport to be a complete description of the securities, markets or developments or any other material referred to herein. The information on which this report is based, has been obtained from publicly available sources and private sources which may have vested interests in the material referred to herein. Although GRI Equity and the distributors have no specific reasons for believing such information to be false, neither GRI Equity nor the distributors have independently verified such information and no representation or warranty is given that it is up-to-date, accurate and complete. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates and/or their directors, officers and employees may from time to time have a position in the securities mentioned in this report and may buy or sell securities described or recommended in this report. GRI Equity, associates of GRI Equity, the distributors, and/or their affiliates may provide investment banking services, or other services, for any company and/or affiliates or subsidiaries of such company whose securities are described or recommended in this report. Neither GRI Equity nor the distributors nor any of their affiliates and/or directors, officers and employees shall in any way be responsible or liable for any losses or damages whatsoever which any person may suffer or incur as a result of acting or otherwise relying upon anything stated or inferred in or omitted from this report.